the empowered investor

Investment Principal #4:

Using Investment Factors To Pursue Higher Returns

Enhancing Your Evidence-Based Portfolio by Optimizing Return Factors

Key Takeaways

- To take your evidence-based portfolio from good to great, you can also invest in return factors, or attributes that drive higher returns in the securities that possess them.

- Among stocks, you can tilt toward factors that are expected to offer persistently higher returns for the extra measure of investment risks involved. Stock factors include market, size, value, and profitability.

- Among bonds, you may tilt toward factors that that offset stock market risks, while still offering a measure of risk-adjusted returns. Bond factors include credit and term.

- By mixing and matching these factor-based asset classes into a personalized portfolio, you can pursue higher expected returns while managing the investment risks involved.

“You pick your risk exposure and then you diversify the hell out of it.”

At this point, we have good news: Even if you’ve only applied the first three principals we’ve covered in our four-part Investment Principal series, you’re already way ahead of the average investor. Investing in asset classes, diversifying them globally, and using passive index or index-based funds are the critical building blocks for any evidence-based investor. And yet, sadly, too many investors never discover these essentials.

To take your evidence-based portfolio construction from good to great, we’ve got one more principal to go: investing in return factors.

- Asset class investing

- Diversification

- Passive or index-based market exposure

- Return factors

If you could earn karate belts for your level of investing enlightenment, tilting your portfolio toward return factors would make you a black belt master. Better still, you don’t have to dedicate years of your life to perfecting your craft. Today’s introduction will take you far.

What Are Return Factors?

First, what is a return factor? As we covered in our book, The Empowered Investor:

“An investment [return] factor is an attribute that drives higher returns in the securities that possess it. To be considered a factor, research must prove that an attribute is sensible and pervasive across markets, persists across time periods, and can be captured cost-effectively in well-diversified portfolios.”

As you build your stock portfolio, you can tilt toward factors that are expected to offer persistently higher returns for the extra measure of investment risks involved. In your bond portfolio, you may tilt toward factors that do a better job at offsetting those stock market risks, while still offering a measure of risk-adjusted returns.

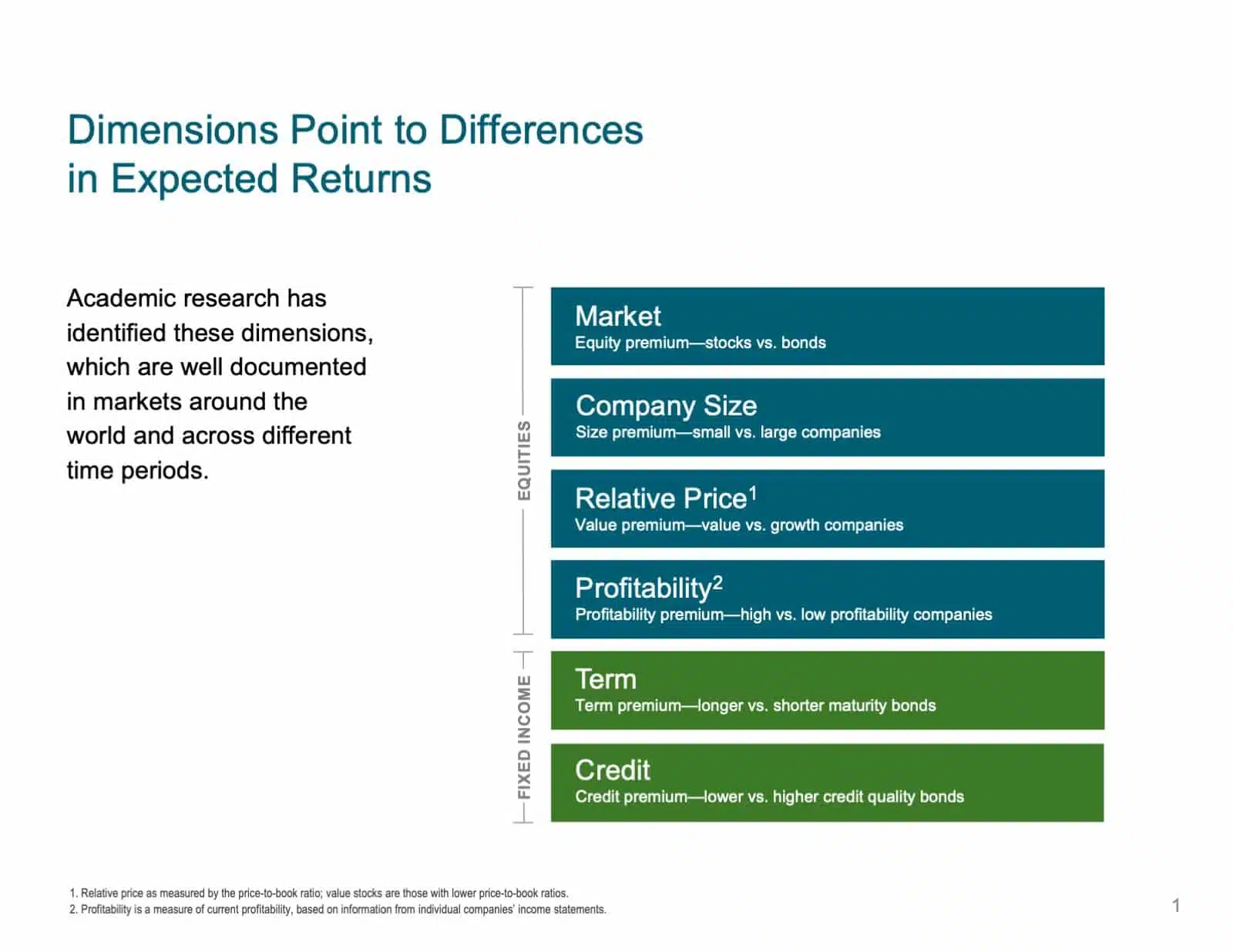

Stock (equity) factors include:

- Market: Stocks in general have delivered higher, risk-adjusted returns than bonds.

- Value: Low-priced “value” stocks offer higher expected returns than high-priced “growth” stocks.

- Size: Small company (“small cap”) stocks offer higher expected returns than large company (“large cap”) stocks.

- Profitability: Companies with a high gross profitability offer higher expected returns than companies with a low gross profitability.

Bond (fixed income) factors include:

- Term: Based on maturity date, short-term bonds offer a more stable experience than long-term bonds, but with lower expected returns.

- Credit: Based on credit quality, highly rated bonds offer a more stable experience than lower-rated (“junk”) bonds, but with lower expected returns.

Our friends at Dimensional Fund Advisors have created a handy graphic to summarize these six factors.

Asset Classes vs. Factors

By now, you may be wondering: What’s the difference between a factor and an asset class? To review, here’s a working definition for asset classes from our previous piece:

“An asset class is a group of investments that share similar characteristics and behave in approximately the same way [in response to various market conditions].”

~ Ruben Antoine, EBI Principle #1: Invest in Asset Classes

Building on this definition, factors represent some of those “similar characteristics”. They’re like the sand, gravel, and water that go into forming the asset classes we then use to create a well-diversified investment portfolio.

For example, asset classes may include Canadian large-cap growth stocks; international small-cap value stocks; high-quality intermediate-term bonds; and so on.

By using passive index funds or ETFs to mix and match the right measures of factor-based asset classes into a personalized portfolio, you can pursue the expected returns you desire while managing the investment risks involved. No strategy guarantees success, but we feel this approach offers you the best, most cost-effective odds.

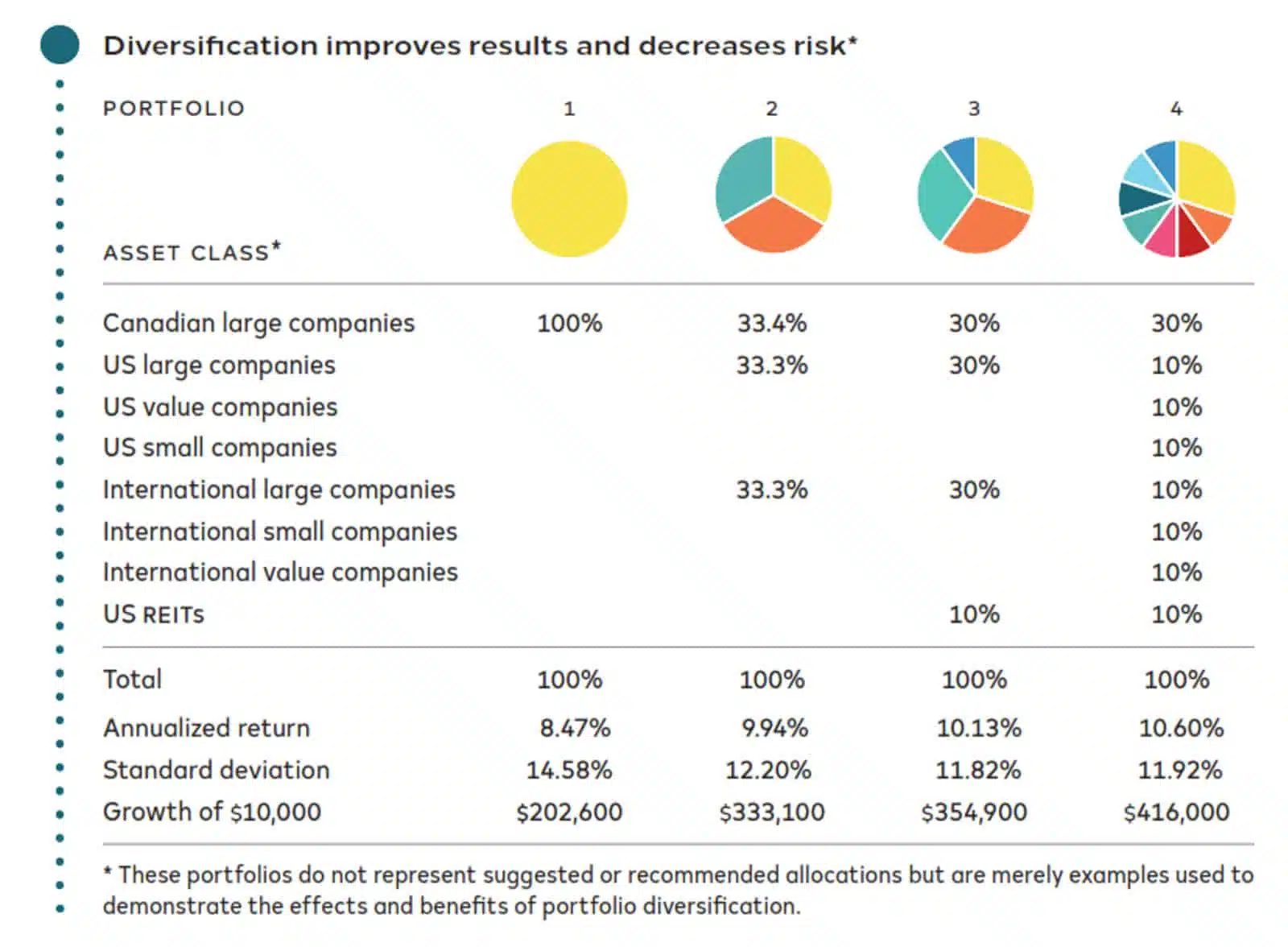

To illustrate, here’s one example of how to enhance an equity portfolio’s expected returns while reducing its overall volatility (as measured by standard deviation). We accomplish this feat by diversifying across various factor-based asset classes:

Source: Canadian large companies = S&P/TSX Composite Index; US large companies = S&P 500 Index; US value companies = Russell 1000 Value Index; US small companies = CRSP Deciles 6-10 Index; International large companies = MSCI EAFE Index (net div.); International small companies = Dimensional International Small Cap Index; International value companies = MSCI EAFE Value Index (net div.); US REITs = Dow Jones US Select REIT Index. 31 January 1982 to 31 December 2018.

To emphasize the fine print, these models are merely examples, not necessarily the right mix for you. Whether you’re working with a financial advisor or flying solo, you’ll want to create a personalized Investment Policy Statement to help you create your custom blend.

Finding the Factors

Another lingering question may be, how did we come up with the six factors described? Why aren’t there more, or less of them? As we described in our Empowered Investor book, it took a while:

Rolf Banz of the University of Chicago Booth School of Business first identified the “small company effect” in 1981 by analyzing NYSE companies from 1926 to 1975. He concluded that, over long periods of time, small companies behave differently than larger companies and have higher expected returns.

In a 1992 study of stock market returns dating back to 1927, Eugene Fama and his colleague Kenneth French not only confirmed Banz’s findings—what they called the company size factor—they also determined that two additional factors produce variation in portfolio returns: the market factor and the company value factor.

Fama and French’s “three-factor model”—as it became known—was further refined in 2012, when Robert Novy-Marx discovered the company profitability factor. A professor at the University of Rochester’s Simon Graduate School of Business, Novy-Marx proved that, when predicting expected returns, a company’s gross profitability has roughly the same weighting as—and is complementary to—the value factor.

Over time, these, and a select few additional factors have been added—but only after passing a lengthy and rigorous gamut of requirements. As described by financial authors Larry Swedroe and Andrew Berkin, for a factor to be useful for our purposes, it must be:

- Persistent: The factor should “historically deliver reasonably reliable returns”.

- Pervasive and Robust: It should show up not just in a random markets, singular timeframes or individual formulations, but over time, and “in a variety of locales and asset classes”.

- Intuitive: There should be a rational for reason why it exists, and why we should expect it to continue.

- Implementable: Perhaps most importantly, we need to be able to capture the expected factor premium after its implementation costs. Many factors have been identified that have not (yet) met this requirement. Or sometimes, pursuing one factor might negate the expected premium from another, more powerful one, in which case it becomes impractical to pursue them both.

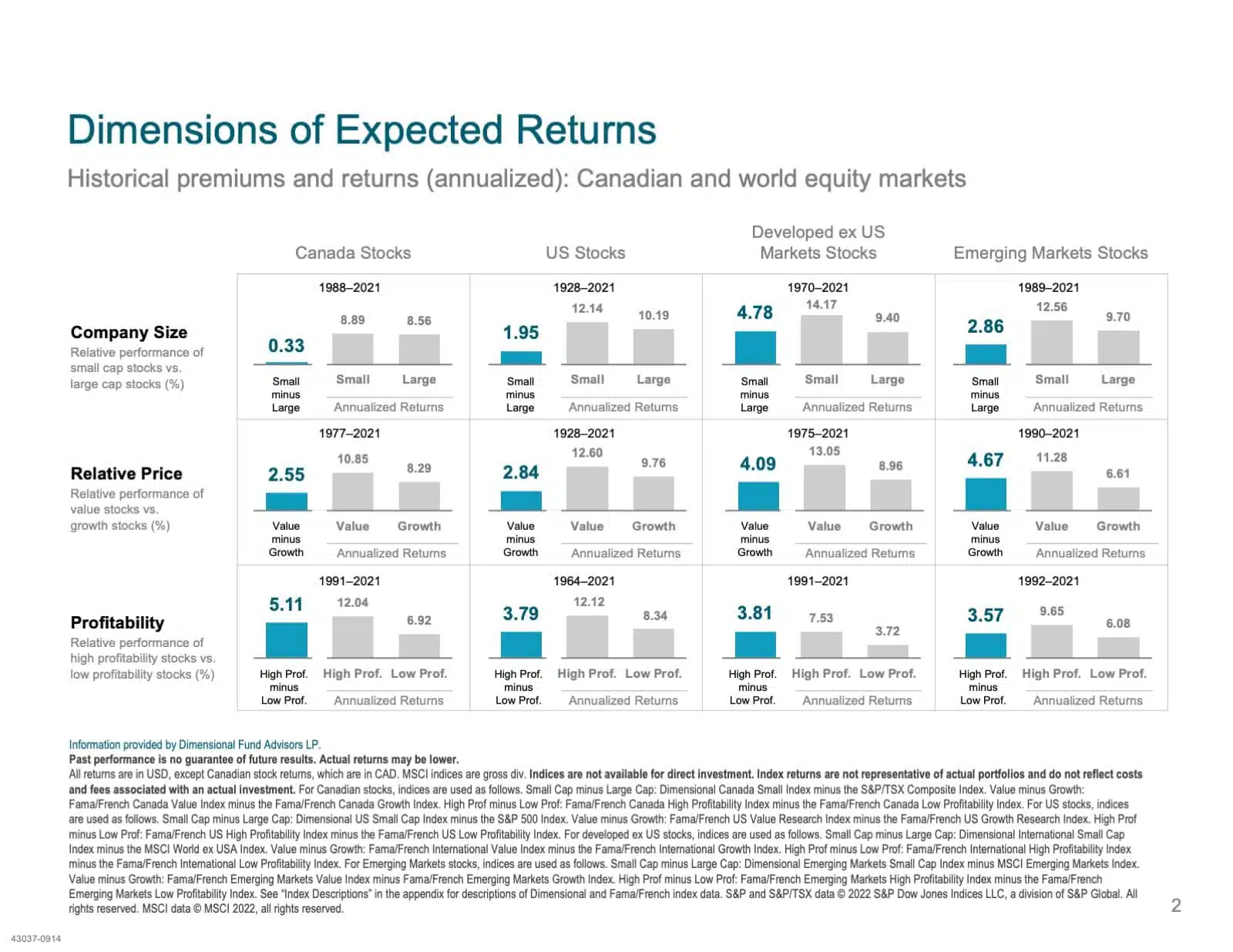

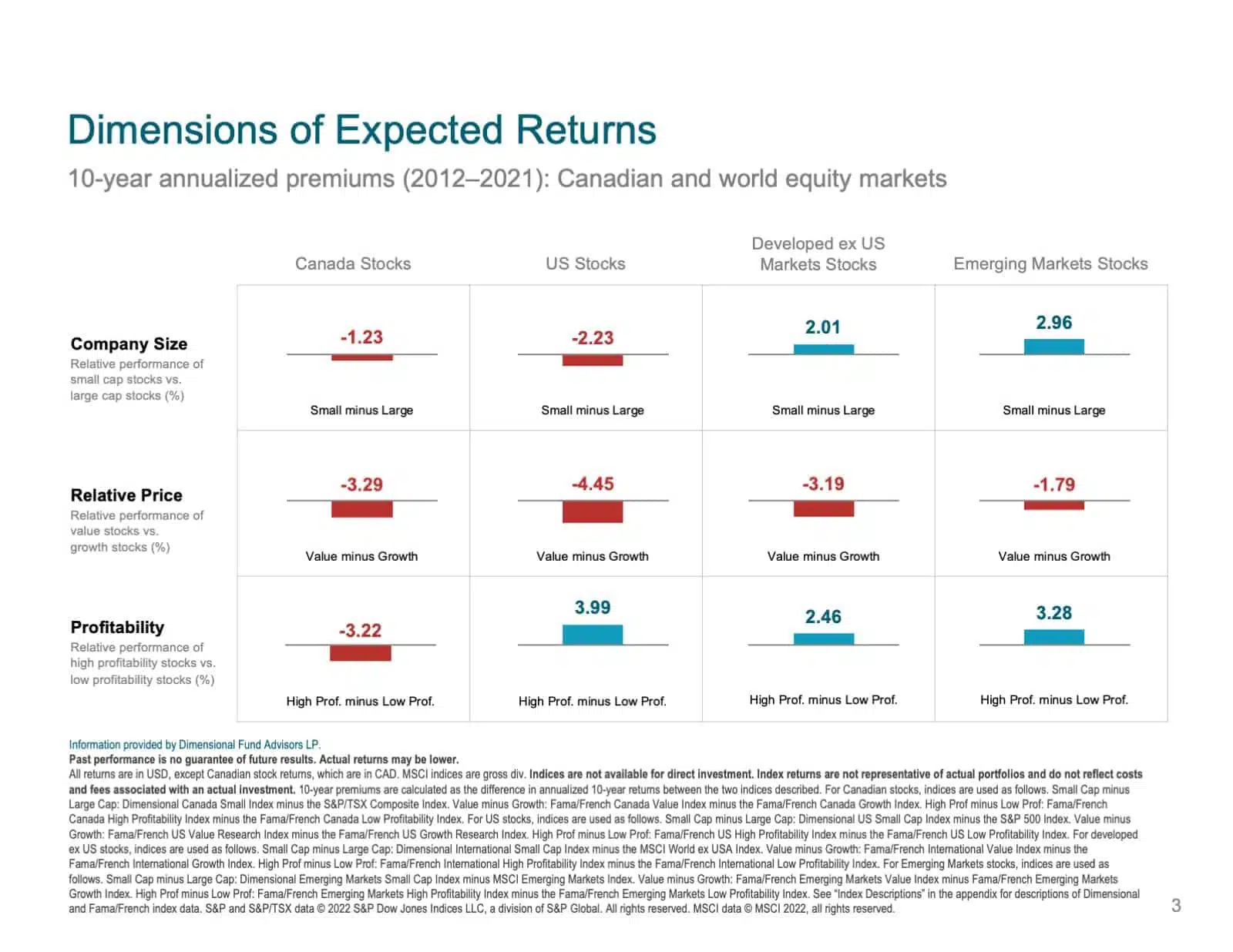

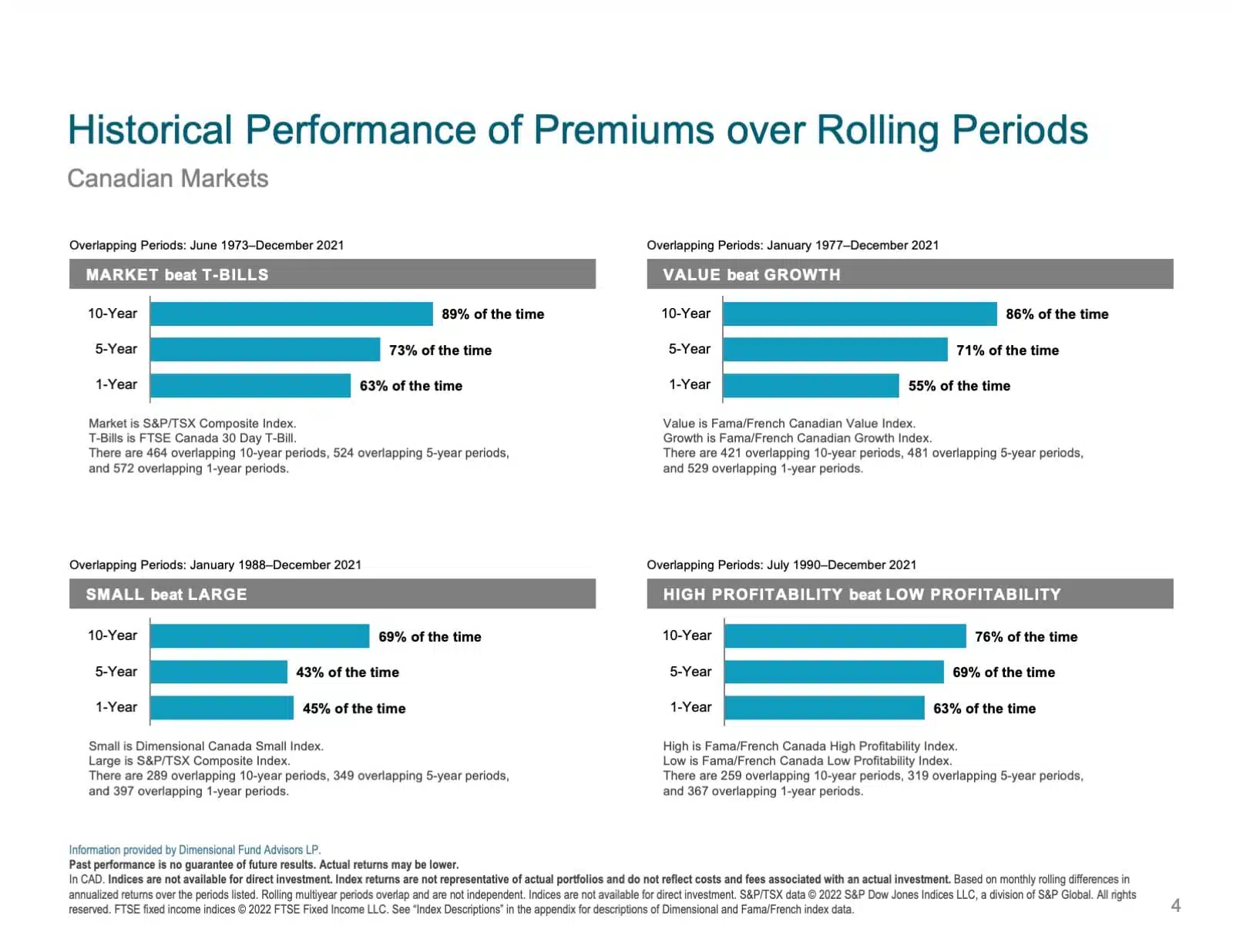

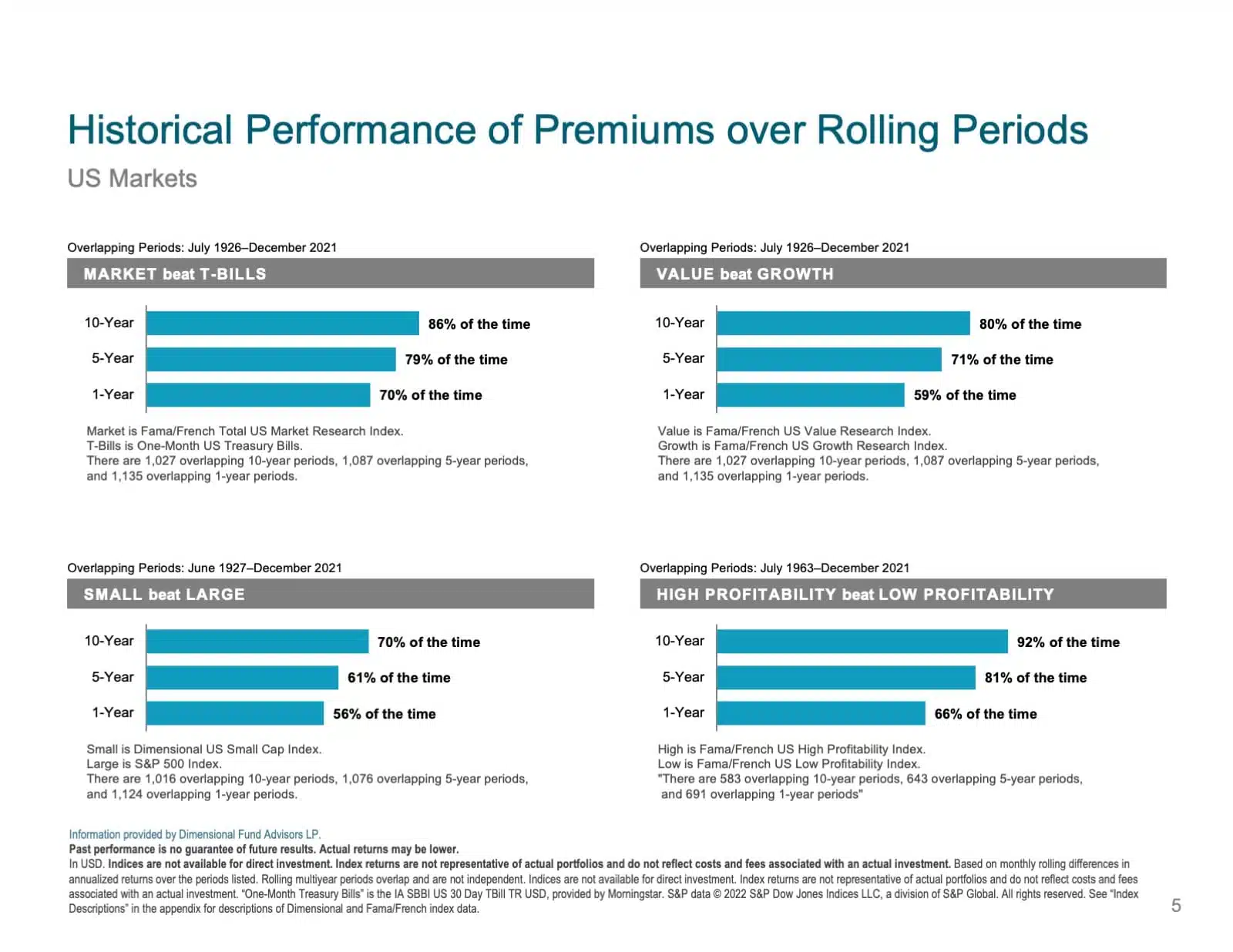

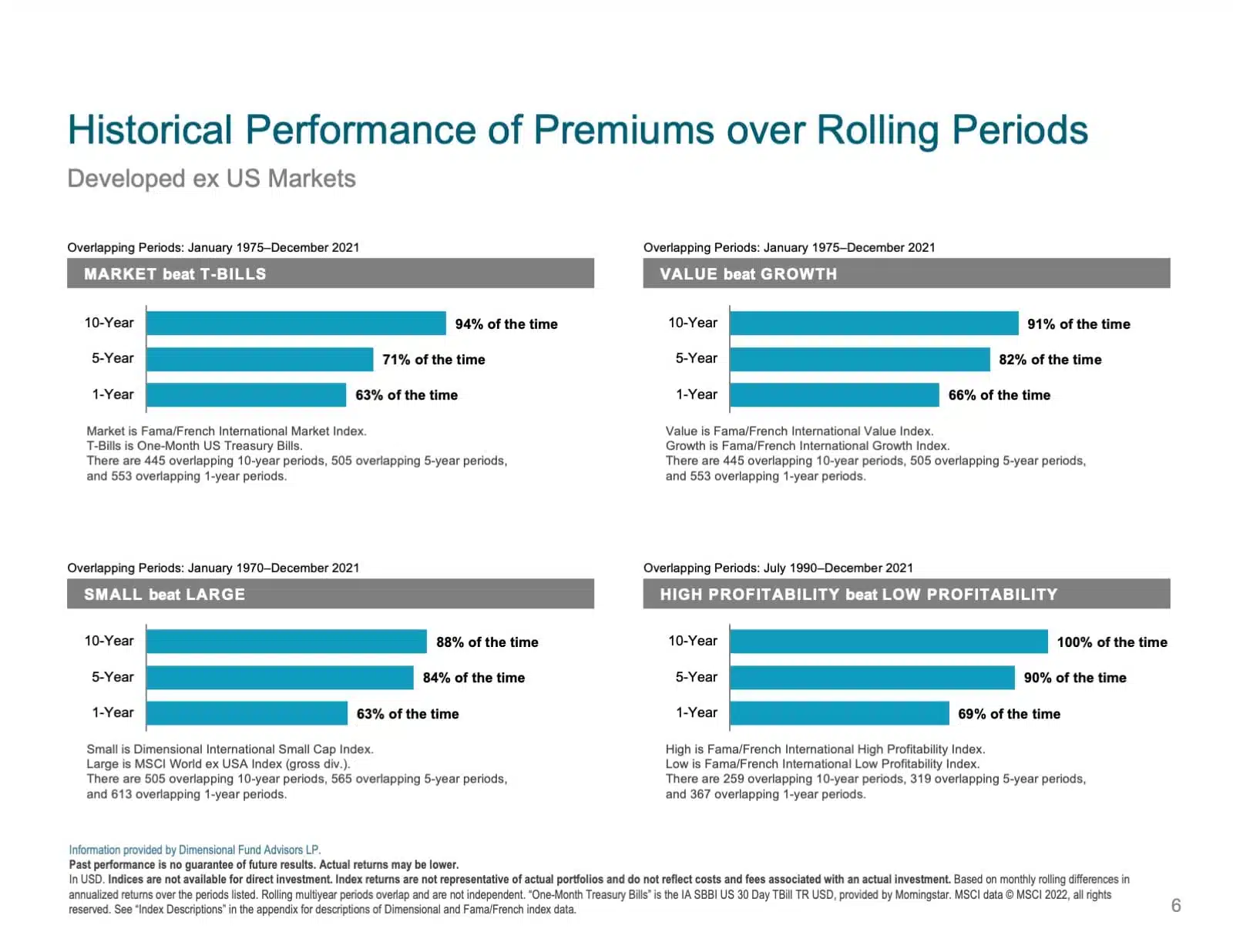

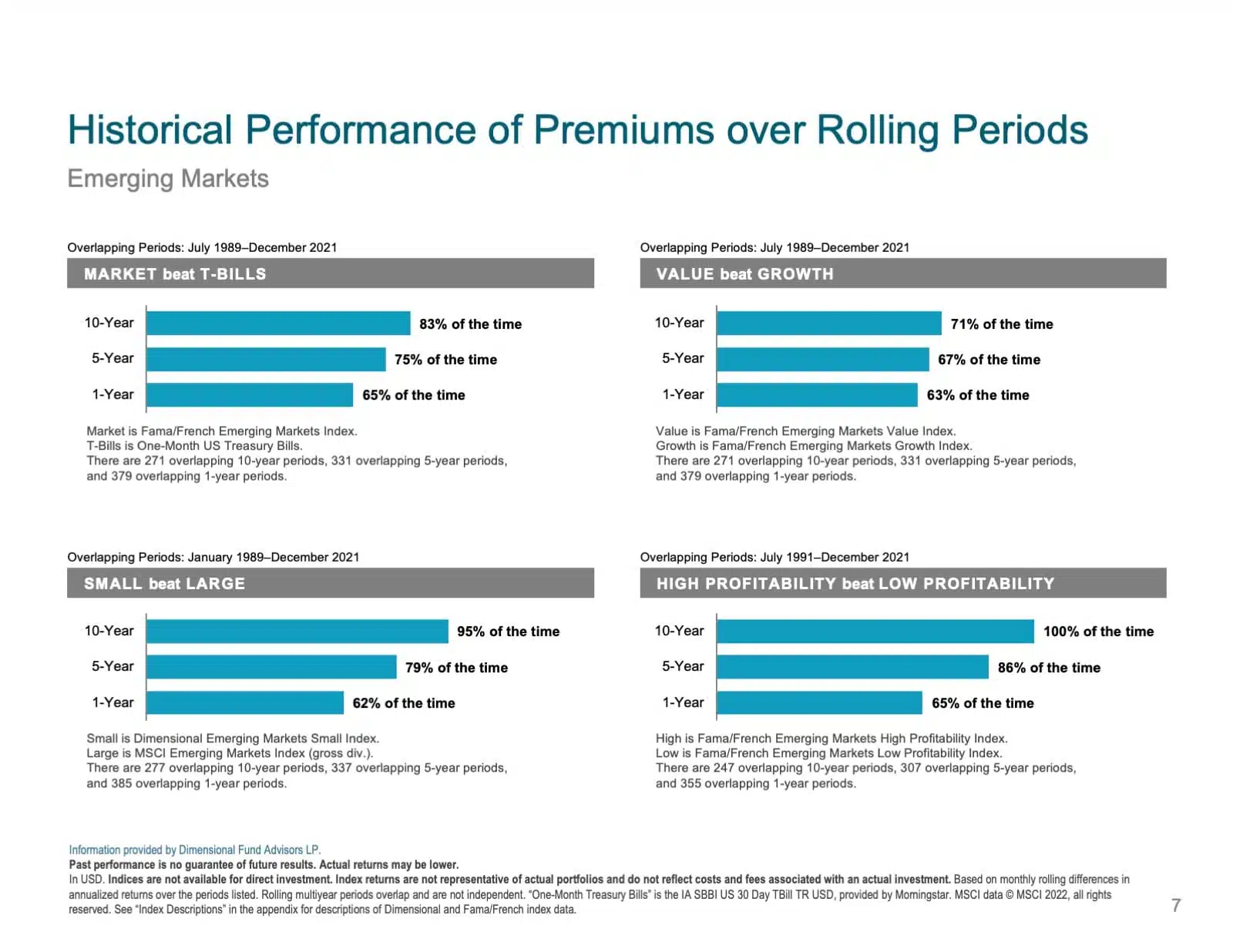

Historical Factor Returns

(click image for downloadable pdf )

Four Equity Factors … or Fewer?

So, to circle back to the beginning, it’s possible to be an effective, evidence-based investor even if you simply buy and hold sensible allocations to the broad market, using low-cost index-based funds or ETFs. You may not consider yourself a “factor investor” if you do. But when it comes right down to it, if all you do is invest more heavily in stocks than bonds, you have signed on to pursue an element of the original factor identified: the market factor.

By thoughtfully blending in a few more equity factors—including size, value, and profitability—you can further enhance your long-term expected returns … as long as you’re able to tolerate the heightened investment risks that accompany them. This means staying put when the risks arise, even if it takes years or decades to play out.

An evidence-based financial advisor can help you optimize the right factor-based portfolio for you. Or, if you don’t want or need to mess with that, stick with the broad market, and your work is done. Even Fama himself once said (in this Rational Reminder Podcast):

“My hope is to have less factors that you need rather than more, because the simpler the world is, the easier it is to deal with it.”

~ Nobel Laureate Eugene Fama

Who can argue with that? If you have questions or comments about what you’ve read so far, please reach out to us today. We love hearing from our readers!

Additional Reading:

- Your Complete Guide to Factor-Based Investing, by Larry Swedroe and Andrew Berkin

- Rational Reminder Podcast Episode 200: Eugene Fama, by Cameron Passmore and Ben Felix

- And, as always, our own book: The Empowered Investor

More Winning Investment Principals

Investment Principal #3: Using Passive/Index Funds or ETFs

Index-based or passive asset class funds focus on how to reduce the costs and frictions involved in capturing the market’s generous expected returns over time.

Investment Principal #2: Diversify Your Asset Classes

The magic behind diversification is found in a financial measure known as correlation, or the degree to which two asset classes move in similar patterns.

Investment Principal #1: Invest in Asset Classes

Evidence suggests your portfolio’s asset class mix has a much larger impact on its variation of returns, compared to stock-picking and/or market-timing techniques.

Stay on top of your financial education

Subcribe and follow to get updates on important wealth management topics.

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect