By Ruben Antoine CFA, CPA, CA, Portfolio Manager

Every year, millions of Canadians make charitable donations to various non-profit organizations. Donors often feel a sense of pride and accomplishment when they share their good fortune with those in need. Donating is a way of expressing our values, promoting our beliefs, and contributing to the well-being of others.

To encourage the gifting process, the federal and provincial governments provide tax incentives to individuals who wish to extend their generosity.

For many, donating might have meant writing a cheque to the chosen organization. While a taxpayer can donate an amount up to 75% of his net income, it is not always the most tax-efficient way to support the causes you care about.

Instead, Canadians may consider donating “in-kind” some appreciated investments (stocks, bonds, mutual funds or ETFs) directly to their chosen charity. Most non-profit organizations are now set up to receive investments in this manner. Once they receive the transferred securities, they may keep or sell them in order use the proceeds to fund their projects or operations.

Let’s explore two common ways to donate and their tax-advantageous alternatives:

Giving cash vs. appreciated investments in-kind

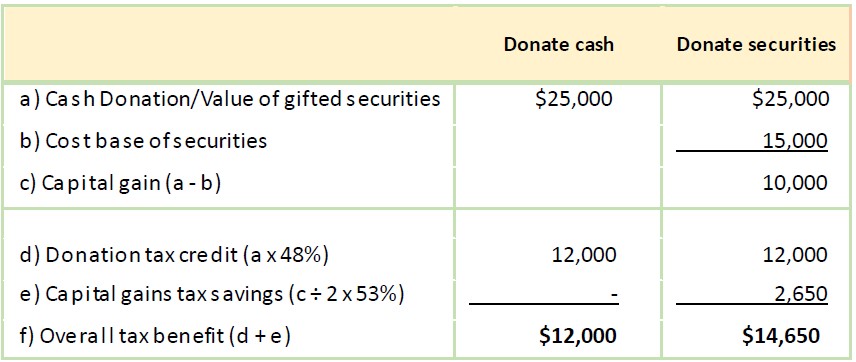

The table below illustrates the case of an individual with an investment portfolio who wants to donate $25,000. Instead of sending cash, a better way would be to donate appreciated investments worth $25,000 by transferring them directly to the charity. The amount of $25,000 is being arbitrarily used for this example; there are no minimum or maximum limits to the size of a gift.

Essentially under both the cash and investment options, the donor will receive a charitable donation tax credit of $12,000. However, by giving appreciated securities outright, no taxable gains are realized, even if the assets are deemed to have been disposed. The individual therefore avoids paying the capital gains tax that he would have incurred when ultimately selling the securities. When adding the donation tax credit, this extra saving increases the overall tax benefit to $14,650 vs. $12,000 under the cash option. This is therefore the most tax-efficient way to complete this charitable gift. It also presents an opportunity for the donor to use the $25,000 available cash to then reacquire the same donated investments and therefore reset the cost at a higher base. By doing so, the portfolio stays intact, but the capital gains tax has been eliminated.

Assumptions:

- For simplicity purposes, we ignored the first $200 and assumed the first-time donor’s super credit does not apply

- We assumed a combined marginal tax rate of 53%, and a combined charitable donation tax credit of 48%

- We assumed the adjusted cost base of the donated investments to be $15,000

Giving appreciated investments personally vs. through a company

Companies and their owners can also benefit by gifting investments with accumulated gains. The mechanics of gifting through a corporation are similar to gifting personally, but with some additional advantages.

Giving securities in-kind provides a corporate tax deduction for the fair market value of the donated investments. This deduction can be used to reduce corporate income and thereby the tax payable by the company. This differs from personal donations where a non-refundable tax credit is received.

Corporate giving has one more advantage over personal giving. As with personally owned investments, the gifted securities are deemed to have been disposed generating a tax-exempt capital gain. However, 100% of this capital gain is added to the company’s capital dividend account (CDA), instead of 50% as it would be if the securities were simply sold. The CDA is a notional account used to pool certain amounts that can be distributed as tax-free dividends to its shareholders.

For instance, let’s assume the same individual in the previous scenario makes the gift through his holding company. The charity receives the investments worth $25,000, and this also creates a $25,000 tax deduction for the company. Assuming that the CDA had a nil or positive value and that the gifted securities had a cost base of $15,000, the entire $10,000 capital gain becomes a tax-free dividend available to the individual. This is a major advantage for the donor since it allows for future withdrawals of funds from the company in a tax-efficient manner. Simply put, giving through a company benefits the charity, the company and the business owner.

How we can help

At TMA, we can help you integrate your philanthropic objectives in your overall financial plan in the most effective and tax efficient way. This includes deciding the amount and timing of the charitable gift, evaluating the impact on your taxes and selecting the right asset to donate. It may allow for a greater contribution to the causes dear to your heart while realizing tax savings. A better way to donate combines the contribution to the well-being of your community with the achievement of your financial goals.

Note: This article should not be viewed as tax or legal advice. It aims to illustrate some general tax benefits available to Canadian donors. One should consult their tax accountant before implementing any of these strategies.