2024 Market Review

A Year of Exceptional Market Performance

If 2024 were a performance, it would be an encore to 2023’s strong returns. Across cash, bonds, and equities, markets delivered another stellar year, solidifying a two-year period of remarkable gains that few could have predicted. Notably, 2024 marked the first time since 1998 that the S&P 500 rose by at least 20% in consecutive years.

Market Highlights

Since January 1, 2023, the MSCI All Country World Index has surged 50.21%.

2024 performance by asset class (in CAD):

- Canadian stocks: +21.65%

- U.S. stocks: +35.62%

- International stocks: +12.63%

- Emerging market stocks: +16.62%

- Canadian bonds: +4.23%

- Global REITs: +11.49%

These gains were supported by moderating inflation, strong corporate earnings, and easing recession fears, further amplified by the Bank of Canada and U.S. Federal Reserve cutting interest rates earlier in the year. U.S. equities, once again, outshone global peers, underscoring the enduring theme of “U.S. exceptionalism.”

Lessons from Two Outstanding Years

Back-to-back years of exceptional market performance are rare and highlight the rewards of staying invested during uncertain times. These results, unimaginable in 2022 or even mid-2023, reinforce the importance of patience, discipline, and evidence-based investing.

As we look ahead to 2025, the future remains uncertain. However, history reminds us that a diversified, long-term approach is the most reliable path to success in any market environment.

Exhibit 1: 2024 Index Returns (in Canadian dollars)

| Fixed Income | |

| Cash and Equivalents | +4.71% |

| World Government Bond Index 1–5 Years | +3.40% |

| World Aggregate Credit Index 1-5 Year | +4.40% |

| Canadian Short-Term | +5.70% |

| Canadian Bond Universe | +4.23% |

| Canadian Equity | |

| Canadian Stocks (S&P/TSX Composite Index) | +21.65% |

| Canadian Value Stocks | +24.59% |

| Canadian Small Value Stocks | +14.35% |

| US Equity | |

| US Stocks (S&P 500 Index) | +35.62% |

| US Value Stocks | +23.65% |

| US Small Value Stocks | +17.22% |

| Developed International Equity | |

| International Stocks (MSCI EAFE) | +12.63% |

| International Value Stocks | +14.65% |

| International Small Value Stocks | +11.39% |

| Emerging Market Equity | |

| Emerging Market Stocks (MSCI Emerging Market) | +16.62% |

| Emerging Market Value Stocks | +13.37% |

| Emerging Markets Small Value Stocks | +14.08% |

| Real Estate investment Trusts (REITS) | |

| Global REITS | +11.49% |

| Canadian REITs | -2.01% |

| Currencies | |

| Canadian Dollar vs USD | -7.82% |

| Canadian Dollar vs Euro | -1.76% |

| Canadian Dollar vs Australian Dollar | +1.49% |

| Note: Indexes are in the endnotes of this commentary |

TMA Model Portfolio Returns

Highlights of our client portfolios:

- Equities are globally diversified across Canada, the US, developed, and emerging international markets with over 10,000 companies.

- Portfolios include growth companies but have higher exposure to value companies.

- Portfolios include large, mid, and small capitalization companies.

- Value stocks outperforming broad market indices in Canada and international developed markets in 2024.

Exhibit 2: 2024 TMA Model Portfolio Returns

| 30% Equity 70% Bonds | +8.77% |

| 50% Equity 50% Bonds | +12.21% |

| 60% Equity 40% Bonds | +13.95% |

| 65% Equity 35% Bonds | +14.83% |

| 75% Equity 25% Bonds | +16.84% |

| 100% Equity | +21.10% |

| Note: Actual client portfolios may differ due to slightly different asset allocations. These returns are before TMA management fees. Source: Portfolio constituents available in the endnotes of this commentary. |

2024 World Stock Markets Deliver… for Those Who Stayed Invested

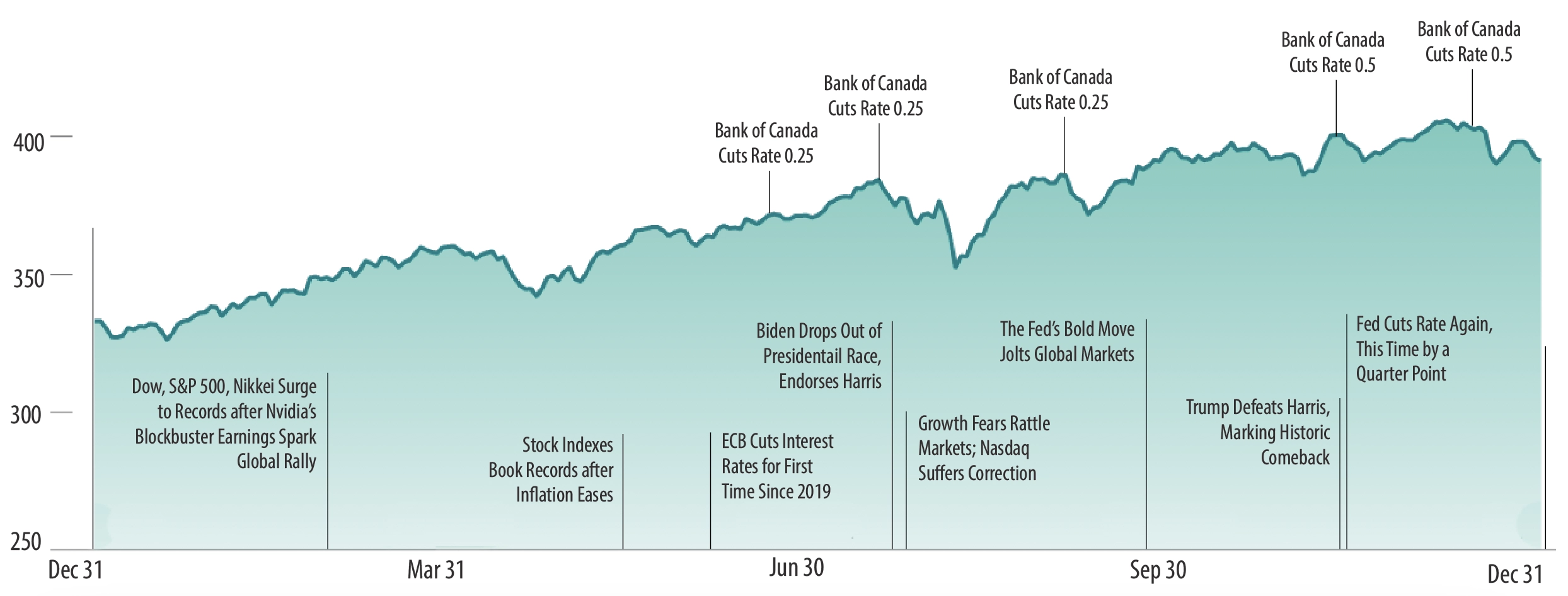

Our 2024 takeaways also apply globally. Exhibit 3 presents select headlines from the year, along with global market moves, as measured by the MSCI All Country World Index. Throughout the year, there were plenty of events sowing seeds of doubt around the world. But these headlines were better viewed as a test of investor discipline throughout the year, instead of as determinants of the market’s overall direction.

As long-term investors we are in pursuit of long-term returns, which are often delivered just when we least expect them. Thus, investors are best served by tuning out the headlines and committing to a long-term investment approach, unaffected by the daily news.

Exhibit 3: MSCI All Country World Index with select 2024 headlines.

In USD. MSCI All Country World Index, net dividends. MSCI data, MSCI 2024, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior.

How Did 2024 TMA Model Portfolios Perform?

Exhibit 4: TMA Model Portfolio Returns (as of December 31st, 2024)

The table below lists various TMA portfolio allocations using Dimensional asset class strategies and their respective annual returns from 2006–2024.

2024 and Calendar Year TMA Model Portfolio Returns

| Date | 30% Equity 70% Bonds | 50% Equity 50% Bonds | 60% Equity 40% Bonds | 65% Equity 35% Bonds | 75% Equity 25% Bonds | 100% Equity |

|---|---|---|---|---|---|---|

| 2006 | 7.87% | 11.43% | 13.22% | 14.11% | 15.90% | 20.44% |

| 2007 | 1.54% | -0.26% | -1.15% | -1.60% | -2.49% | -4.64% |

| 2008 | -7.01% | -13.99% | -17.35% | -19.00% | -22.23% | -29.96% |

| 2009 | 10.40% | 14.53% | 16.59% | 17.62% | 19.67% | 24.90% |

| 2010 (1) | 8.52% | 10.23% | 11.05% | 11.45% | 12.05% | 14.17% |

| 2011 | 1.96% | -1.12% | -2.69% | -3.46% | -5.34% | -9.05% |

| 2012 | 7.65% | 9.13% | 9.86% | 10.22% | 10.94% | 12.66% |

| 2013 | 6.83% | 12.18% | 14.94% | 16.32% | 19.38% | 26.27% |

| 2014 | 6.59% | 7.37% | 7.74% | 7.95% | 7.93% | 9.19% |

| 2015 | 3.18% | 4.08% | 4.51% | 4.73% | 5.12% | 6.17% |

| 2016 (2) | 6.09% | 8.24% | 9.31% | 9.85% | 10.49% | 13.54% |

| 2017 | 5.55% | 7.80% | 8.94% | 9.51% | 10.40% | 13.59% |

| 2018 | -1.87% | -3.38% | -4.14% | -4.53% | -5.27% | -7.30% |

| 2019 | 9.49% | 11.95% | 13.19% | 13.81% | 14.63% | 18.22% |

| 2020 | 5.16% | 5.89% | 6.13% | 6.22% | 5.98% | 6.24% |

| 2021 | 5.13% | 9.60% | 11.87% | 13.03% | 15.53% | 21.32% |

| 2022 | -8.35% | -7.51% | -7.11% | -6.91% | -5.82% | -5.61% |

| 2023 | 8.38% | 10.00% | 10.81% | 11.22% | 11.73% | 14.09% |

| 2024 | 8.77% | 12.21% | 13.95% | 14.83% | 16.84% | 21.10% |

| Summary Statistics (January 1st 2006 to Dec 31st 2024) | ||||||

| 1-Year Return | 8.77% | 12.21% | 13.95% | 14.83% | 16.84% | 21.10% |

| 3-Year Return | 2.61% | 4.51% | 5.46% | 5.94% | 7.13% | 9.26% |

| 5-Year Return | 3.62% | 5.79% | 6.85% | 7.38% | 8.52% | 10.94% |

| 10-Year Return | 4.02% | 5.70% | 6.52% | 6.93% | 7.72% | 9.69% |

| 18-Year Return | 4.37% | 5.48% | 6.01% | 6.27% | 6.72% | 7.93% |

| Growth of $1 | $2.30 | $2.83 | $3.12 | $3.27 | $3.56 | $4.43 |

| Standard Deviation | 4.58% | 6.58% | 7.66% | 8.21% | 9.24% | 12.18% |

| Actual client portfolios may differ due to slightly different asset allocations. Model portfolio returns are before TMA management fees but after Dimensional Fund Advisor management fees. (1): As of January 1st 2010, TMA Model Portfolios include DFA Investment Grade Fixed Income (F). (2) As of January 1st 2016, TMA Model Portfolios include DFA Targeted Credit Fund (F). |

U.S. Stock Market: Strength, Concentration and the Case for Diversification

The U.S. stock market has exhibited remarkable strength in recent years, outperforming global peers in what’s often referred to as “U.S. exceptionalism.” Since 2010, $1 invested in the S&P 500 would now be worth $10, compared to $5 for global stocks.

Key Drivers of U.S. Outperformance

- Earnings Growth: U.S. companies, especially in technology, have excelled at innovation, growth, and profitability.

- Tech Leadership: Large-cap technology companies, the “Magnificent Seven” (Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, Nvidia), have driven a significant portion of U.S. market returns. In 2024, these companies accounted for nearly one-third of the S&P 500’s weight and roughly 50% of its gains.

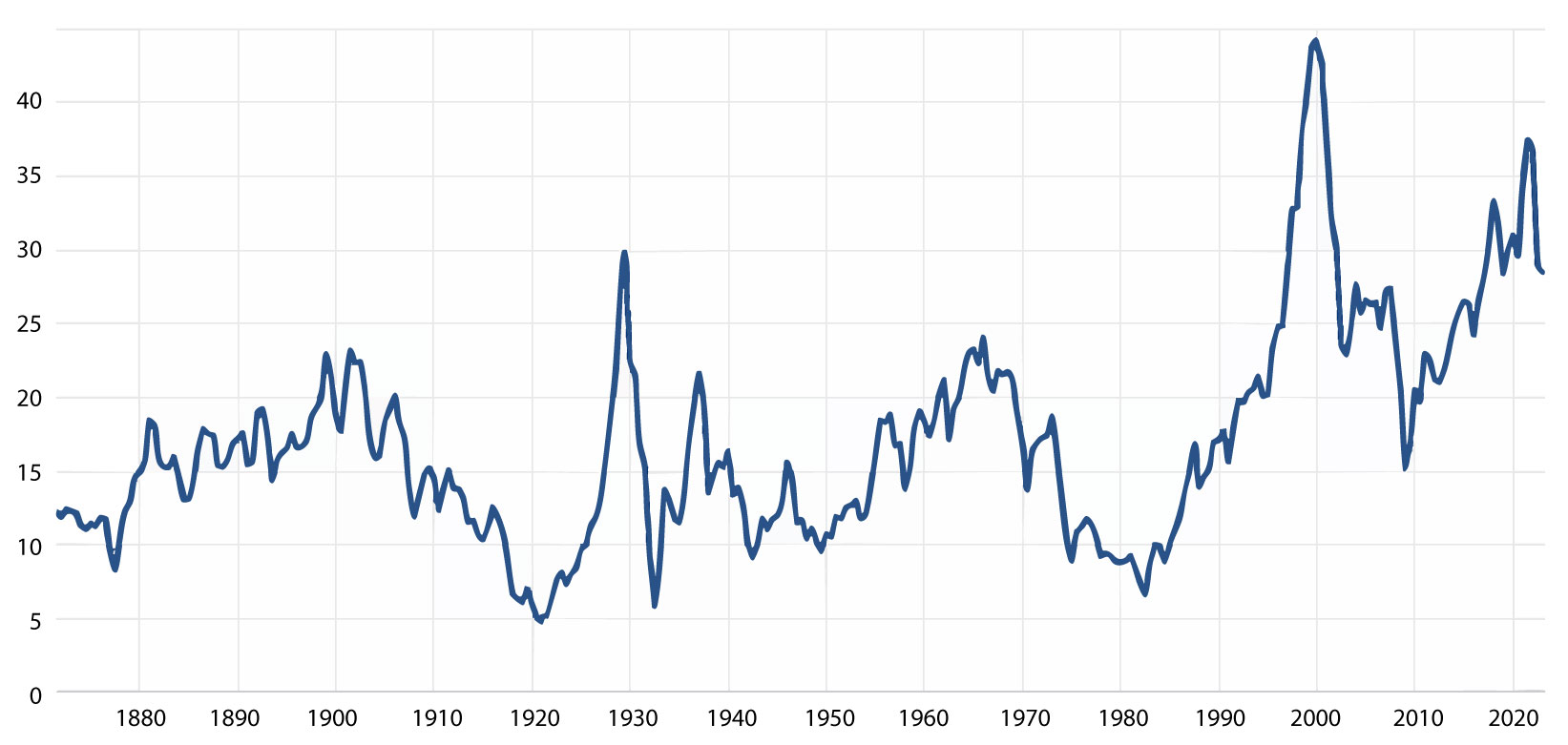

- Valuations: Higher valuations in U.S. equities have been supported by consistent, high-quality earnings. The U.S. cyclically adjusted price-to-earnings (CAPE) ratio is near its highest level in 143 years, excluding the dot-com bubble.

US Equity Valuations Reach New Heights

Exhibit 5: Measured by US cyclically adjusted price-earnings multiple (CAPE)

CAPE = price divided by 10-year average earnings, in inflation-adjusted terms. Data January 1871-November 2024. Shown for illustrative purposes only and does not constitute a recommendation to invest in the above-mentioned security / sector / country and should not be interpreted as investment guidance. Source: Robert Shiller, Schroders.

Opportunities Beyond U.S. Large-Cap Tech

Valuation Gap: U.S. vs. International Stocks

U.S. equities currently trade at elevated valuations compared to their historical averages and international peers. The MSCI World ex-U.S. Index trades at a near-50% discount to U.S. stocks, suggesting potentially higher future returns for international markets.

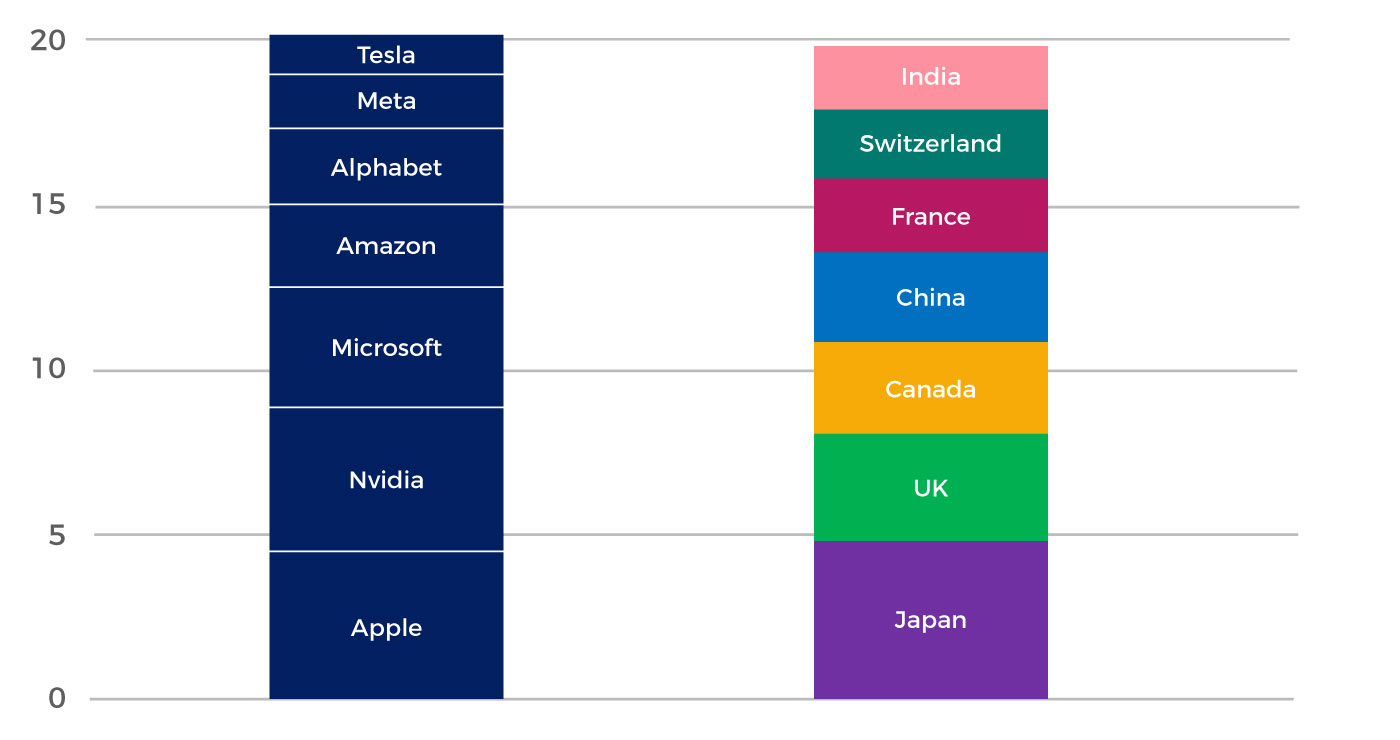

Concentration Risk and the Importance of Diversification

The Magnificent Seven dominate global portfolios, making up a larger weight in the MSCI All-Country World Index than the next seven largest countries combined. While their exceptional returns have benefited investors, this concentration underscores the need for diversification.

Exhibit 6: Weight of Magnificent-7 vs. next seven biggest countries in MSCI All-Country World Index (%)

Source: LSEG Datastream, Schroders.

International Markets: While U.S. large-cap technology stocks have delivered exceptional returns, it’s essential for investors to be internationally diversified. Maintaining reasonable exposure to these innovative companies ensures participation in their growth. Markets outside the U.S., particularly in Europe, Canada and emerging economies, have more reasonable valuations.

Small-Cap and Value Stocks: Both in the U.S. and globally, small-cap and value stocks trade at significantly more attractive levels. A well-diversified portfolio across geographies, and asset classes and styles allow investors to capture higher expected returns while balancing risk, regardless of market trends.

The Importance of Avoiding Narratives, and Predictions

Over the past two years, predictions of a looming recession dominated headlines. In July 2022, a Wall Street Journal survey found economists assigning a 50% chance of recession within 12 months, while former Treasury Secretary Larry Summers deemed it “almost inevitable.”

Some of the prevalent narratives included:

- A severe recession was expected in 2023, possibly extending into 2024.

- Global economies would struggle due to conflicts in Ukraine and the Middle East.

- Stock valuations were unsustainably high.

- Inflation would remain persistently elevated.

- High interest rates would cripple economic growth.

Despite these forecasts, global economies proved more resilient than expected. Stock markets delivered strong results, with global stocks (MSCI All-Country World Index in CAD) posting returns of 18.98% in 2023 and 26.24% in 2024.

Why Avoiding Narratives Matters

While stories and predictions can feel compelling, they often lead to emotional decisions that undermine long-term investment success. Headlines can fuel unnecessary changes to portfolios, but evidence shows that staying disciplined and adhering to a long-term asset allocation strategy is the key to achieving financial goals.

The lesson is clear: Avoid reacting to narratives. Focus on what you can control—diversification, costs, and maintaining a consistent investment plan. Success is built not on predicting market outcomes but on avoiding mistakes and staying the course.

The Power of Human Ingenuity

Amid geopolitical tensions, economic challenges, and electoral uncertainty, 2024 demonstrated the resilience of financial markets and the enduring power of human ingenuity. Once again, markets processed information, set fair prices, and rewarded long-term investors with positive returns.

The year began with concerns over persistent inflation, shifting interest rates, and the ripple effects of conflicts in Ukraine and the Middle East. Some feared a prolonged economic downturn, but businesses adapted and innovated. Human ingenuity kept the economic engine running, solving problems and creating opportunities.

This resilience was reflected in market performance:

- The S&P 500 returned an impressive 35.62%.

- The global stock market (MSCI All Country World Index) rose 26.24%.

- Bonds, which had struggled earlier in the decade, delivered solid returns of 4.40% (Bloomberg Global Aggregate Credit Bond Index 1-5 years).

Investors who stayed the course with broadly diversified portfolios were rewarded for their patience and discipline.

While short-term fluctuations and surprises were inevitable, the long-term picture is clear: Over the past century, fueled by collective ingenuity and productivity, markets have risen, delivering average annual returns of about 10%. By owning a broad slice of global capitalism, investors benefit from the upside of human problem-solving and innovation, wherever it occurs.

A Lesson for 2025 and Beyond

No one can predict what the future holds, but the lessons of 2024 reaffirm the value of timeless investment principles:

Stay disciplined during market ups and downs.

Diversify globally to capture opportunities worldwide.

Balance risk to ensure resilience.

Pursue higher expected returns by maintaining a long-term perspective.

These strategies don’t rely on predictions—they tap into the rewards of human creativity and resilience.

As we enter 2025, questions about the economy, interest rates, inflation, and global markets remain. With these uncertainties come fresh opportunities and challenges.

At Tulett, Matthews & Associates, we are committed to helping you stay focused on your goals, tuning out daily market noise, and maintaining confidence in your plan. This short video illustrates how we strive to provide peace of mind: Tune Out the Noise Video

We look forward to connecting with you soon. In the meantime, please reach out with any questions or concerns—we’re here to help.

From all of us at Tulett, Matthews & Associates, we wish you a happy and healthy 2025.

The Empowered Investor Podcast:

We are committed to bringing our clients perspective, awareness, and continued education. We believe that balanced perspective can help us shape our thoughts, emotions, and actions and can greatly impact our overall wellbeing and sense of peace of mind. Our Empowered Investor Podcast is a way for us to help bring you perspectives. March 2025 will mark our fifth full year of investment and planning episodes for our clients. Attached below is a full list of our 2024 episodes.

- 2023 Financial Year in Review and Looking Ahead for 2024

- How Much is Financial Advice Worth?

- Beyond Borders: Tax Implications for Non-Resident Canadians

- A Simple, Effective & Stress-Free Way to Invest in the Stock Market

- 2024 Federal Budget: Capital Gains Inclusion Rate Impact

- Happy Birthday! The Mutual Fund Structure Turns 100

- Raising Money Smart Kids is the Wisest Investment

- Essential Financial Strategies for Entrepreneurs

- Expert Strategies and Insights for Preparing to Sell your Business

- 2024 Mid-Year Investment Review

- Navigating Market Volatility and the Lessons from Intel

- Maximizing the Disability Tax Credit: Key Insights for Canadians

- The RDSP: Securing a Financial Future for Canadians with Disabilities

- Should you trade on the US Election?

- Thematic Investing: Investment Goldmine or Pitfall?

- Breaking into the Canadian Real Estate Market

Endnotes:

Exhibit 1:

FTSE Canada 30-day T-Bill, FTSE World Government Bond Index 1–5 Years (hedged to CAD), Bloomberg Global Aggregate Credit Bond Index 1-5 Years (hedged to CAD), FTSE TMX Canada Short-Term Bond Index, FTSE Canada Universe Bond Index, S&P/TSX Composite Index, MSCI Canada Value Index, MSCI Canada Small Value Index (net div.), S&P 500 Index, Russell 3000 Value Index, Russell 2000 Value Index, MSCI EAFE Index (net div.), MSCI EAFE Value Index (net div.), MSCI EAFE Small Value Index (net div.), MSCI Emerging Market Index (net div.), MSCI Emerging Markets Value Index (net div.), MSCI Emerging Markets Small Value Index (net div.), S&P/TSX Capped REIT Index and the S&P Global REIT Index (net div.). Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

Exhibits 2 and 4:

In CAD. Performance is net of DFA management expense ratio (MER) but before TMA management fees.

100EQ/0FI:

DFA Canada Canadian Core Equity Fund Class F: 33.3400%, DFA Canada International Core Equity Fund Class F: 33.3300%, DFA Canada US Core Equity Fund Class F: 33.3300%.

75EQ/25FI:

DFA Canada Canadian Core Equity Fund Class F: 25.00%, DFA Canada Five-Year Global Fixed Income Fund Class F: 12.500%, DFA Canada International Core Equity Fund Class F: 25.00%, DFA Canada US Core Equity Fund Class F: 25.00%, DFA Canada Global Targeted Credit Fund Class F: 12.500%.

65EQ/35FI:

DFA Canada Canadian Core Equity Fund Class F: 21.6700%, DFA Canada Five-Year Global Fixed Income Fund Class F: 11.6700%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 11.6600%, DFA Canada International Core Equity Fund Class F: 21.6600%, DFA Canada US Core Equity Fund Class F: 21.6700%, DFA Canada Global Targeted Credit Fund Class F: 11.6700%.

60EQ/40FI:

DFA Canada Canadian Core Equity Fund Class F: 20.0%, DFA Canada Five-Year Global Fixed Income Fund Class F: 13.3400%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 13.3300%, DFA Canada International Core Equity Fund Class F: 20.0%, DFA Canada US Core Equity Fund Class F: 20.0%, DFA Canada Global Targeted Credit Fund Class F: 13.3300%.

50EQ/50FI:

DFA Canada Canadian Core Equity Fund Class F: 16.6700%, DFA Canada Five-Year Global Fixed Income Fund Class F: 16.6700%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 16.6600%, DFA Canada International Core Equity Fund Class F: 16.6600%, DFA Canada US Core Equity Fund Class F: 16.6700%, DFA Canada Global Targeted Credit Fund Class F: 16.6700%

30EQ/70FI:

DFA Canada Canadian Core Equity Fund Class F: 10.0%, DFA Canada Five-Year Global Fixed Income Fund Class F: 23.3400%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 23.3300%, DFA Canada International Core Equity Fund Class F: 10.0%, DFA Canada US Core Equity Fund Class F: 10.0%, DFA Canada Global Targeted Credit Fund Class F: 23.3300%

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect