Chasing Trends, Losing Wealth: The Tactical Allocation Trap

Can tactical allocation boost returns? This episode breaks down Morningstar’s latest research on market timing, risks, and why long-term investing may be the smarter move.

Can tactical allocation boost returns? This episode breaks down Morningstar’s latest research on market timing, risks, and why long-term investing may be the smarter move.

How will new US-Canada tariffs impact trade, the economy, and investors? This episode breaks it down, exploring market reactions, history, and smart investment strategies.

If 2024 were a performance, it would be an encore to 2023’s strong returns. Across cash, bonds, and equities, markets delivered another stellar year, solidifying a two-year period of remarkable gains that few could have predicted.

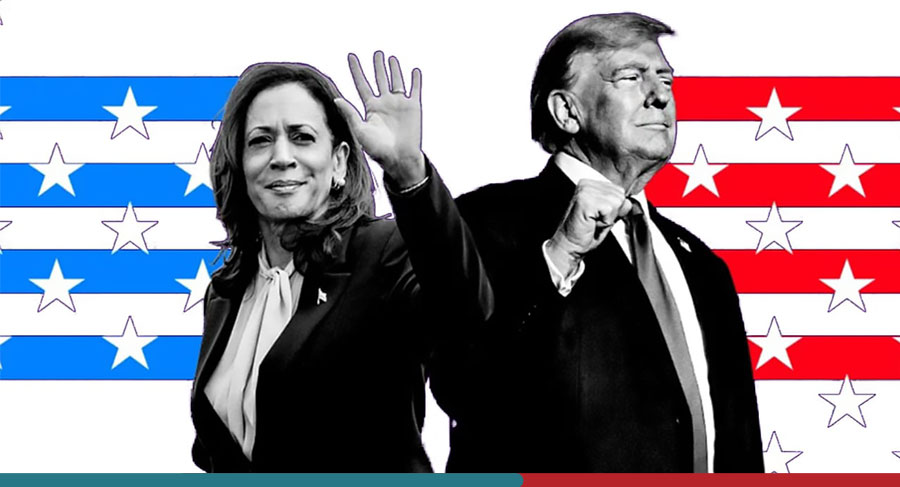

What is impact of trading on the U.S. election on your portfolio? We break down election myths and offer long-term investment insights for savvy investors.

Explore the Disability Tax Credit and learn how this underutilized benefit can support Canadians with disabilities and their families. Discover eligibility, application tips, and more.

Join our discussion on maintaining composure during market fluctuations, long-term investment approaches, and insights from Intel’s successes and setbacks.

Stay ahead of the curve and make informed investment decisions with our in-depth analysis of global trends, tech impacts, and economic shifts. Gain valuable insights on key market trends and navigate uncertainty for effective financial management .

How did the key financial events of 2023 shape the investment landscape? What lessons can investors take from these developments as we move into 2024? Join us in this episode as we delve into these questions and more.

In today’s episode, we dissect the elusive concept of a “soft landing” economically, analyzing the potential for such an outcome in the current U.S. economy.

In this episode, we dissect the intricate world of dividend investing, breaking down common assumptions and exploring its role within a well-rounded investment strategy.

How much should you invest in different global markets? We dive into the nuances of valuations and expected returns adding clarity and confidence in global diversified portfolios.

Learn the benefits of global diversification for Canadian investors along with actionable strategies to gain better returns with less volatility.