EBI – Principle #1: Invest in Asset Classes

There are 4 main principles of evidence-based investing every empowered investor needs to know, today we start with investing in asset classes

There are 4 main principles of evidence-based investing every empowered investor needs to know, today we start with investing in asset classes

An evidence-based strategy is a scientific approach to investing where investment decisions are based on historic facts and research.

An investment policy statement empowers you as an investor – consider a map for how we invest today, tomorrow, and in the future

Having a properly diversified portfolio is the best defense against the unexpected events that inevitably affect the financial markets.

It’s natural to want to outsmart the market and it’s easy to see why timing the market and chasing performance are so tempting. But don’t!

What are the main sources and dangers of financial predictions and how have some past predictions stacked up against actual outcomes?

Today we discuss why you need a strategy to avoid making investment mistakes and the components and criteria of an investment philosophy.

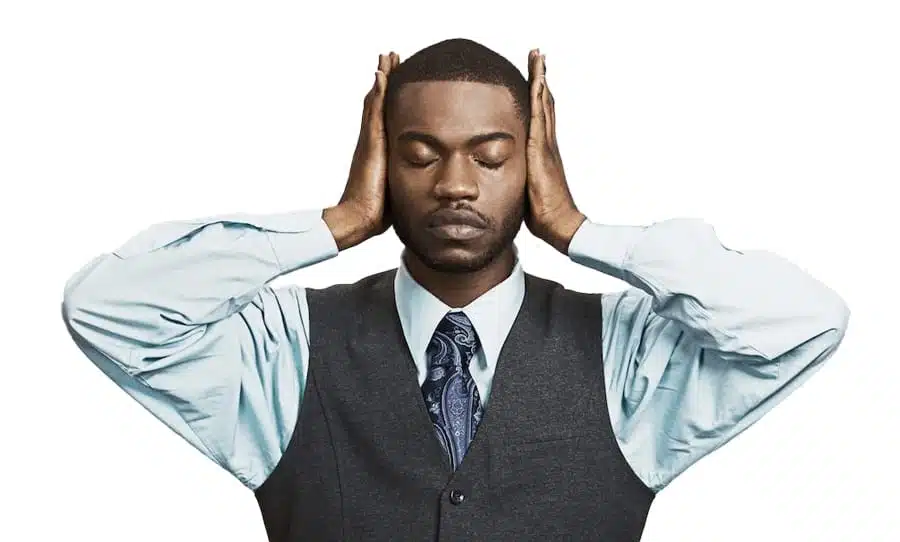

Investment “noise” can be obstacles on the path to investment success – what are the main sources and how you can block them out?