Marcelo Taboada

Associate

Deciphering Cryptocurrency:

Bitcoin, Bubbles and Sir Isaac Newton

I’ve had no shortage of conversations with people asking me about my thoughts on Bitcoin Cryptocurrency over the past year. Allow me to put my two cents in.

Bitcoin is a Cryptocurrency: a digital currency that allows its holders to use it as a method of payment when executing transactions. Unlike the cash in your pocket or the money in your portfolio, Bitcoin is not issued by a central bank and its transactions are processed by a network of computers in something called “blockchain”.

This blockchain technology is where a cryptocurrency lives. In a nutshell, a blockchain is a database of encrypted transactions that can be seen by everybody in the participating network.

For example, Canadian dollars are maintained and processed by the Bank of Canada. For a cryptocurrency, the blockchain maintains the records of the transactions in the participating computers and every change or entered transaction must be approved by the whole network. This is how the problem of double spending (where the same currency could be used to do more than one transaction) is avoided. For a detailed explanation of the blockchain, please click here. The inherent privacy of blockchain is one of its main selling points, but it has also made it an appealing tool for black market transactions and fraud.

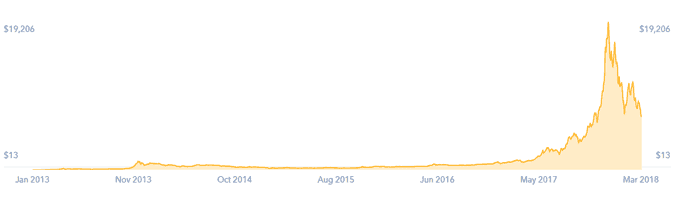

Price of Bitcoin in USD, January 2013- March 2018:

It’s easy to see why people would be excited. Others are riding the wave and making money, so it stands to reason that I should do the same. Years of research into human psychology have demonstrated that humans often allow biases and emotions to influence our decisions, including the ones we make with our investments. It’s a pitfall that has been trapping investors for centuries.

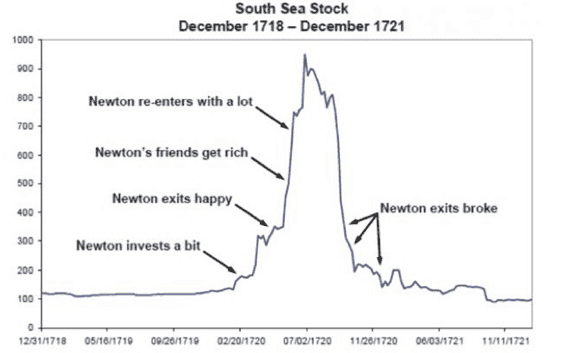

Case in point: the South Sea Company and Sir Isaac Newton.

Established in the early 18th Century and granted a monopoly on trade in South America and its surrounding islands in exchange for assuming England’s war debt, the South Sea Company was one of the hottest stocks of its time. The renowned physicist Sir Isaac Newton invested his life savings into the company and sold his stock at a time when he was satisfied with his returns.

As you can see above, the stock continued to climb. Newton, ever aware of his intellect but blinded by his ego, could not abide his pals getting richer while he missed out. He bought the stock at a higher price and ended up selling at a loss. He had this to say after losing his life savings, “I can calculate the movement of stars, but not the madness of men.”

If it could happen to Sir Isaac, it could happen to anyone.

I’ve heard the term “Bitcoin Millionaire” or people leaving stable jobs to become “cryptotraders” quite a few times over the last few months. Friends, acquaintances, and even a few Uber drivers talk casually about investing in cryptocurrencies as though they are destined to only go up. This speculative strategy is devoid of any type of analysis; people are just buying cryptocurrency in the hope of selling it at a higher price to someone else. This is called the greater fool’s theory.

I have yet to see anything compelling about how to value a cryptocurrency. Unlike stocks and bonds, cryptocurrencies have no future cash flow, therefore it is hard to come up with a valuation model. They have a price, but they do not have value.

In conclusion, buying cryptocurrencies does not align with the wealth management approach we employ at Tulett, Matthews & Assoc. Evidence-based investing would not live up to its name if it included products or strategies that relied on little more than short-term speculation. This is not to say that cryptocurrencies won’t become reliable stores of value in the future, we’d rather not speculate either way. Our investment philosophy pushes us to question everything that comes our way and ensures that we develop consistent parameters in how we manage our investments. Cryptocurrencies may be new and exciting, but as of now they have no place in a disciplined and sustainable wealth management process.