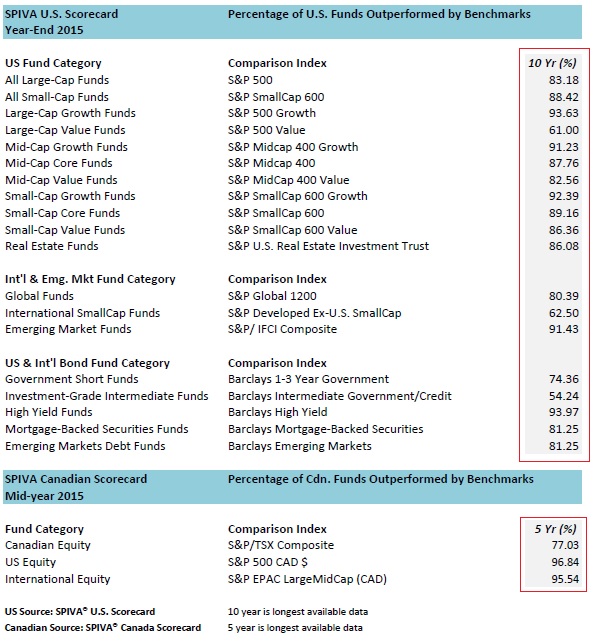

SPIVA’s (S&P Indices vs. Active) newly released edition of their scorecard saw active managers in a wide range of asset classes overwhelmingly underperform against comparable benchmarks over one-year, three-year, five-year, and ten-year periods.

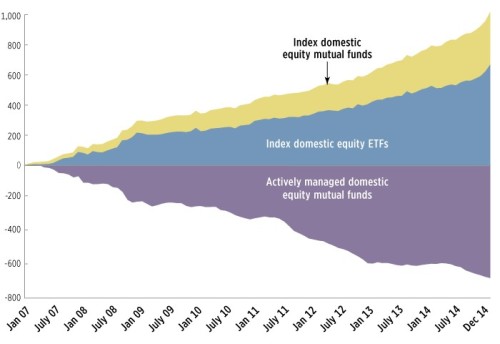

The failure of active managers to meet their index benchmarks is just one of many reasons why investors are abandoning active management for passive strategies. The chart below shows the movement of investments from actively managed funds to passively managed funds between 2007 and 2014.

Accumulative flows into equity funds. Source: Investment Company Institute

While we have been proponents of passive, index-based strategies for twenty years, it is always encouraging to see others embrace an approach we know to be effective.