Episode 112:

Market Volatility and Trump’s Tariff Wars

Keith: Welcome to The Empowered Investor. My name is Keith Matthews, and I’m joined by my co-host Marcelo Taboada. Marcelo, how are you today?

Marcelo: Keith, I’m doing great. Not so excited to be talking about the subject we’re going to talk about today, but I think it’s necessary given all the volatility that we’re living through.

Keith: Today’s show is specifically geared towards discussing market volatility—how it’s actually playing out right now, where it came from, some of the recent decisions we’re seeing from the U.S. administration, some of the tariff issues around the world, and how to get through it. I think we’ve got some great points to review.

We’re here to try to help investors right now. So, Marcelo, give us a bit of a debrief as to how we got here—what has transpired in the last two months?

Marcelo: I’ll try to be brief, but have you heard the expression, “It takes a generation to build a forest, but it takes one person to burn it down”?

Keith: I have, but you’re going to elaborate on it, and it’s quite good.

Marcelo: I think that’s a bit of what we’re living through now. Donald Trump is pretty much turning the international rule-based order that we’ve had for the last 80 years—which has created all the success and profits and progress for a lot of nations—he’s turning it on its head and announcing tariffs against enemies, friends, allies all over the world. And it’s been a volatile road, on and off. As you’ve seen in the markets, markets have reacted violently about all this—announcement and backing off of tariffs. He’s announcing deals on the side on certain things, and that led to Liberation Day, which is the big announcement he had last week. So, we’re April 10th today. That was last Wednesday. And yeah, it’s been a wild ride.

Keith: As Canadians, we recall it started off with Trump having tariffs against Mexico and Canada. And then some of the comments with regards to the 51st state—and I think Canadians have been quite patriotic and rallied around this. And then by the time we get to Liberation Day, he’s no longer just picking on his two closest geographic allies—now he’s going after the world. And we’re talking 60 nations. So, can you describe a little bit about what actually Liberation Day was about? And then we’ll jump into some of the market returns that have surrounded that day.

Marcelo: Yeah, so Liberation Day was this—you know, historically most presidents have chosen the Rose Garden to announce big days in American history. He chose to do this in the Rose Bowl, which is funny, I think. And it was an announcement, a broad announcement of mass tariffs to everyone in the world. Most of the countries of the United States, they claim, have deficits against them. It was a baseline tariff of 10%, and then depending on the country, you could see more aggressive tariffs like you’ve seen in China—less aggressive in others. But at a baseline level, it’s been a 10% tariff for everyone.

And that was the announcement on Liberation Day. Ever since that day, we’ve seen tremendous volatility. I mean, Keith, I’ve been in the business for 10 years, but I don’t remember seeing that much violence intraday and then day over day in the stock market. I’ve seen big days…

Keith: Marcelo, that’s because you’re young.

Marcelo: Yes.

Keith: Okay, so there have been dates—we have these other days. COVID had, in terms of what we call VIX, which is the volatility index—right? COVID was more dramatic. In 2008, the credit crisis—that was more dramatic. But this period was nonetheless very dramatic as well. So right after the actual Liberation Day on the 2nd, he announced it at four o’clock in the afternoon.

On the 3rd, the S&P 500 was down 5%. So, 5% is a big day. And then the next day, it was another 5%. So, a 10% is a correction. We had a stock market correction in two days. Two days. And then we get to the point where we have a weekend—everybody pauses for a bit—and then that Monday on the 7th at four o’clock in the morning, the futures were down 5 or 6%.

Marcelo: I think everybody was expecting—I include myself there—some reason and maybe some negotiations happening over the weekend. And that didn’t happen, obviously.

Keith: I think the marketplace in general—and a lot of people have commented on this—actually weren’t expecting Donald Trump to get to this point. They were expecting a lot of banter, a lot of talk, and that…

Marcelo: The day before Liberation Day was a huge day in the market.

Keith: Yeah. And they thought, well, there’s just no way that this would come through. Who would put a country—who would risk an entire economy, forget about the global economy—their own economy to play this game of chicken?

And nobody thought that it would go through. And then Liberation Day did come through, and these massive tariffs were put down on all sorts of countries. Canada and Mexico actually got some reprieve, which was very short-lived. But a lot of other countries—the EU, a lot of countries in Asia, Japan, China—these tariffs were enormous. With that brought an immense amount of uncertainty. We had the 5%, the 5%, and then the 7%. That 7% day didn’t close 7%, I believe it closed kind of flat, but nonetheless, you’re dealing with a kind of a correction of 16%, even though it wasn’t closing the day at 16%. It was intra kind of period at 16% over three days. That’s big.

Marcelo: It is big.

Keith: These are just big numbers. We were approaching bear market territory. And then a few days later, we had a couple more percentage points and we had technically, in these periods, gone into a 20% correction—very close to it.

So, you know, we talked about the volatility index because we’ll sort of bounce around on a couple of concepts here. Do you want to take a moment and just explain the volatility index? I alluded to it before, but just let our listeners know exactly what it is and kind of what these levels were.

Marcelo: The VIX is a metric that we follow closely in the market. It really measures the volatility in the markets. So, the higher it is, the more volatility you’re experiencing in the market. We’re not going to get into the details of how it’s calculated, but that’s essentially—it’s an indicator that you can follow.

Keith: It’s better known as the Fear Index.

Marcelo: So, the higher it is, the more volatility you’re living. If you look at the numbers from 2008, that reached almost 80. COVID was about 60. And what we’re living through now—it was hovering around 50–53. We’re getting close to—not panic numbers—but fearful numbers.

Keith: Yeah. And when you get to these periods—call it 2012 to 2020—so a seven-year period, you had VIX indexes that were coming around mid-teens. So you go from mid-teens, and then moderate volatility would be 20–25. You start getting up into 50 and 55—and these are high numbers. And volatility goes both ways, right? It goes down, obviously, and up.

So, we talked about the periods where the market went down, but then yesterday we had a period where the market was down about 2%. And then I think somewhere around noon—I was actually on a client call—and I checked something quickly, and I saw that the S&P 500 was up a full 6%. What happened that day?

Marcelo: They announced a 90-day pause on the tariffs announced on Liberation Day. So, it’s no more tariffs for 90 days. The China tariffs are still on, so there is that to note. But the rest has been paused for now.

Keith: The Liberation Day tariffs—the ones that were before—are still on. And this is where it’s kind of confusing. You almost need to follow a map to understand what’s the latest tariff in place. The new ones that were put in place on Liberation Day were paused—except for China. So that seems to be the big fight now, the big positioning. And we ended up finishing the day with the S&P 500 up about 9.5%, which is a big day.

Marcelo: It’s a big day in the markets.

Keith: Now, I remember you telling me yesterday—you said, “Oh my God, I don’t think I remember seeing a big day like that.” I said, Marcelo, there have been these big days. Investors—we tend to forget them. We all remember the big down days, but the big positive days are there too.

They just seem to be forgotten about. But we got a nice list here. Marcelo, why don’t you share with the listeners just some of the big five positive days?

Marcelo: So COVID was one of them. So, March 13th, we went through a 9.9% up day. Same year, March 24th, 9.3%. During the 2008 crisis, we had a huge up day for about 10%. Also in the same year, October 13th, we got another positive day for about 11.5%. So, you see—and these are all big days that are almost sandwiched between a crisis. And that’s what I find interesting about this. Like, for people who want to cash out of the market, missing those days—it’s huge.

Keith: And I remember, we were talking yesterday—I remember when I woke up sometime in November 2020 and I looked at my phone to see what the market had done, and it was up 7%.

Marcelo: That was when they announced the vaccine, right?

Keith: That was exactly when they announced that Pfizer had found a cure, and that it was 90%—it had a 90% efficiency or efficacy level, which was just an incredible morning. And the market was overjoyed. It went up 6%. So, these days do happen. Yesterday was one of those days where the market bounced back tremendously. Donald Trump reversed his course, gave people 90 days. Why did he give people 90 days? What happened to make him change his mind?

Marcelo: Well, a few things. The market had a succinct but very strong message to him in the last few days. That’s a big message for him because he always boasted in his first presidency about how strong the stock market was with him. So, I know he’s looking at this. But this is important because this is not the opinion of one person or a corporation. This is the collective opinion of millions of people who are trading in the market, and I think that means something.

Then the other thing too is the bond market. Like we were talking about off mic, a lot of people think that the bond market—you know, when markets go down, bond markets tend to hold the fort, not experience too much volatility. But we went through a period in the last five days where yields were up, which means the prices of bonds were down. And that’s sending a message to Donald Trump. I mean, the bond vigilantes, like you call them.

Keith: Yeah. I mean, the bond market had an important message to state. And I think it was on the tops of the stock market going down. You were getting CEOs across the country telling the administration they need to change their way. You had Jamie Dimon stepping up—the largest bank CEO. You had major entrepreneurs doing the same thing. You actually had even Republican politicians—this is a weekend right after all the protests, which I don’t think the protests did very much.

Marcelo: Even Elon Musk got into a spat with Peter Navarro, who’s the big proponent of the tariffs in the Trump team.

Keith: Yeah, but back on your bond point—as a former bond trader 30 years ago, the bond market was always known as this sort of sleepy giant. Everybody kind of always gets excited about the stock market, but the bond market really has a big message.

What essentially happened in the last few days is interest rates on U.S. Treasuries—10-year bonds—rose from about 4% to 4.5%. Now, you would think the opposite should be occurring if we’re signaling uncertainty and a recession and people flocking to safe haven. So, U.S. Treasuries have always been considered a safe haven. So, what was happening in the last four days is international investors were saying, “Actually, I’m not going to buy the U.S. currency and U.S. Treasuries.”

They walked away. They pushed away from buying Treasuries, which raises the rates. Now the implications are huge when that happens—so much so that it does change government’s minds. And so, everything changes from that perspective.

When interest rates go up, every country needs to finance its deficit. If you cannot get international investors to give you money, your government could actually be in peril—be shut down for a little bit if you can’t finance it. All of your lending rates—some of the major lending rates in the United States—are pegged off the 10-year. So, mortgages, for example, are pegged off of that number. And so, when that increases, everybody’s mortgages go up.

Marcelo: Business owners.

Keith: Business owners are going to be affected. Large businesses will be affected because they can no longer borrow at the same lower rates. So, this shift of interest—higher interest rates—really, I think, got to his advisors. And advisors, I think, went to him and said, “You need to change course. This cannot continue. The momentum is picking up.”

You know, a lot of people always said this was going to happen. It was just a matter of time. You cannot make these changes and these ballsy maneuvers without expecting severe ramifications. And yesterday was a day where you saw some of that.

Marcelo: And I think that’s just the other component of trade, right? Like, in a balance of trade, you have the exchange—like exports minus imports—and then you have the capital account. And the United States historically has never been an export economy. They’ve always been—since the ‘70s, ‘80s—a consumption economy. And a lot of the supremacy of the dollar has been because countries like China, Japan are buying U.S. Treasuries and parking their money in them. And that’s the other aspect that the Trump administration is not talking about, which I think is interesting. I mean, they’re choosing not to talk about this component of trade.

Keith: You know, if you go back two months ago, to me the big issue was—the market kind of said, there’s nobody who’s going to take the economy to the brink of a complete recession. Who would do that? This is why it was such a shock for so many people in the investment business—and Wall Street in particular.

Marcelo: Economists.

Keith: Economists—they just didn’t think he would go that far. So he went that far. And we’ve got this massive volatility. Now the big issue is going to be: what is this going to look like? How should we think about this as investors?

Marcelo: You know what’s puzzling too—not to get political—but I think if there’s one thing that far-right economists can agree with far-left economists, it’s that trade is good. It’s an apolitical issue. There’s no economist in the world that cannot agree on that. Like, world trade is a good thing.

I saw this in a book called A Splendid Exchange—it’s a story of trade. Trade is a good thing, right? There’s been a lot of bad things around that—you know, colonialism, slave trade and all that—but it’s been around forever. It’s not just since globalization. And it’s allowed civilization to improve because when countries used to trade, they used to exchange ideas as well. So that pushed civilization upwards. But the fact that he’s attacking that and saying that the United States has been screwed since the ‘80s and abused is just a wrong narrative.

When you look at the amount of money—disposable income—that people would spend on necessities in the ‘40s, ‘50s, and how much every household is spending on those things today, it’s gone down significantly. And the only reason it’s gone down significantly is because of trade. It’s made people’s lives better.

Keith: A hundred percent. So, Marcelo, we’re going to switch gears a little bit here. Now we’re going to talk about: should investors trade through the storm?

Now, we’ve done lots of episodes before where we basically say tactical asset allocation is risky and it shouldn’t be tried, and we shouldn’t do it. We’re going to take a few minutes now and talk about the issue of looking through storms. Then we’re going to talk about the idea of, if we do get into a recession—if—how should we think about this? How are we today—Marcelo and I—going to try to help our listeners get perspective on this so that they feel okay to navigate through?

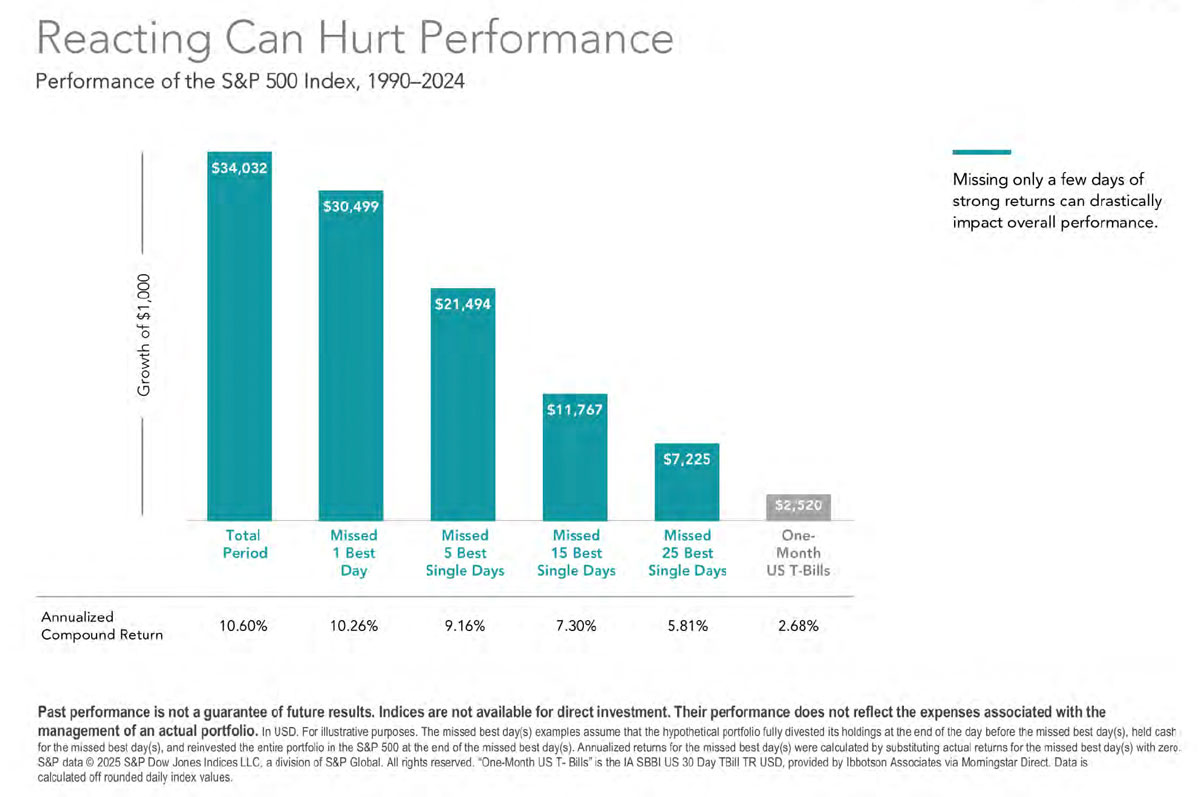

Okay, so let’s start with trading. As I’m saying this, the document I’m looking at right now is what happens when you miss some of the best consecutive days. I think the last four or five days of trading show that in these periods you see big drops and sometimes big positives. So, talk to us about what we’re looking at right now.

Marcelo: This is a very nice chart we’re looking at, and it’s essentially—it’s a graphic example—if somebody invested $1,000 in the year 2000, and then they held that money in the market for 25 years. So, you’re looking at the Russell 3000 as your proxy for this. If you just invested $1,000, in 25 years you would’ve had about $6,600. Twenty-five years—you know, very nice return.

But if you missed one week of trading—from November 28th…

Keith: The best week.

Marcelo: Yeah, the best week, yes. In that period. So that was November 28th, 2008. You would’ve had, instead of $6,600—$5,500. You miss one week. If you miss the best month in that period of 25 years—that was in April 2020—you would’ve had $5,200.

If you miss the best three months, you’re now at $4,600. If you miss the best six months in that period of 25 years, you’re now down to $4,200. So, getting out of the market—timing the market—is always two decisions you have to make: when you get out, and when you get back in. And sometimes if you miss those best days, you can change the whole trajectory of your portfolio. And that’s what’s the tragedy here.

Keith: And if we were to narrate it around this chart here, what we also should be picking up is the idea that the best days are also in the storms.

Marcelo: They’re sandwiched.

Keith: They’re in the storms. Yeah. And most people don’t get out fully before a storm. They see the storm and then they get worried and nervous—rightfully so. We understand why. People have worked hard to generate their capital, have worked hard to build their portfolios. But typically, what happens is portfolios start going down, then they get out, they can’t get back in, and what ends up happening is they wait too long. They wait till everything kind of resolves itself. The market unfortunately slowly starts to go up, then it pops—and they’ve missed that pop. And this is what is so difficult about trying to trade through the market.

The next and most important thing that we wanted to discuss in this section was this idea of tactical asset allocation. Now we just did a show—maybe I think it was two episodes ago, Marcelo—we won’t spend too much time here. Let’s just give the quick summary point of how well tactical asset allocation strategies have done—being professional money management firms that specialize in trying to make bold moves in advance of any market move so that they can protect capital when markets are going down and make more money when markets are going up. And the reality of it is they haven’t.

Marcelo: They haven’t. We looked at the study—it was 20 years. Over 1-, 3-, 5-, 10-, 20-year periods. They still underperform a very boring 60/40 portfolio. You know, how much more time do you need to do your job? Like, I think the numbers are loud and clear.

Keith: What’s also interesting in this period of 15 or 20 years is that they had about 10 times—10 periods in there—where there were major market issues, including the credit crisis of 2008.

Marcelo: Yep. COVID.

Keith: The Greece meltdown, China growth crisis, interest rate hikes—lots of periods where markets are moving swiftly. They had the opportunity to be able to figure out when to get in and out. And at the end of the day, when we add it all up, they still trail—like you said—balanced portfolios that buy, hold, and rebalance or reset by anywhere from two full percent to 3% compounded over 20 years.

Marcelo: Which doesn’t sound like much, but if we show listeners in a graph, they would—it’s massive, for sure.

Keith: Well, not only that—because the next chart shows that essentially not only do they get lower returns, but they have higher risk measured by volatility. So, it’s like a double lose. And that, unfortunately, is a really important message we want to bring to our listeners—is that in any of these periods of volatility, thinking that a person can trade through—sell and rebuy—or even just once on each side, is a fallacy. It’s very difficult to do. And if you think you can do this, you definitely can’t do this every time there’s market volatility—which, in essence, is kind of every year or two. There’s always stuff to deal with.

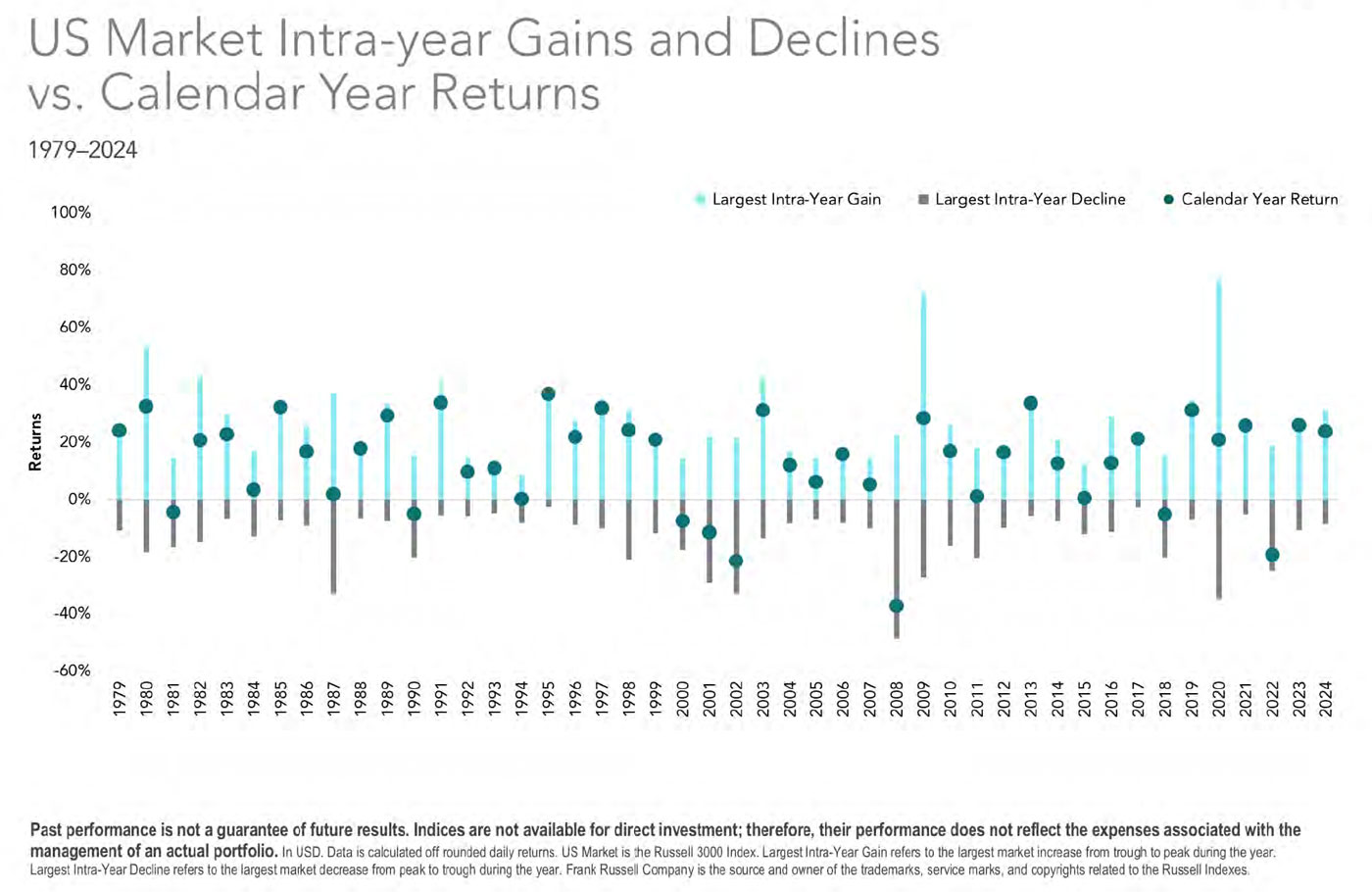

So, Marcelo, one other chart I want to go over before we get to getting through a storm—and that is this one here where we talk about intra-year gains and declines. Essentially what it shows is, over a 40- or 50-year period, the markets can have very large swings within the year and then actually end up being positive at the year-end. Do you want to add a few comments for our listeners?

Marcelo: The biggest takeaway here for me is that just because we’re living through volatility now and the markets are down now, it doesn’t mean that we’re going to end the year on a negative note. We have had years where you’re seeing a lot of volatility and you end up in a positive year—as you can have the first few months of the year very positively, and then we end up in a negative number. So, it’s just—predicting is extremely hard. There’s so much data about this. We’ve talked about this subject so many times, but not one person can know more than the collective wisdom of the crowd, so to speak. So that’s my takeaway when you look at this. I don’t know if you had anything.

Keith: Yeah, that’s a very good point. The only thing I would add is that some of the swings are quite significant. So, we see, in periods in time where the market’s down during the year—could be down 25%—but it finishes positive.

So, if I look at the last six years, many of the years had negative numbers in them. Even if you look at 2020—COVID had a massive negative year by March, but it finished the year significantly positive. So, it just goes to show you how quickly things can turn. And I think with this week’s pause of tariffs, it also goes to show you—it’s got to happen soon, or else we will go into a more difficult economic period.

But at some point, we’ll have individuals that will get together and strike deals and figure out how to agree upon trade—and then we will have better times.

So, Marcelo, we’re going to talk now—kind of wrapping things up—but there’s an important section we have to go through right now, which is getting through a bear market. Getting through a bear market, and also the potential of getting through a recession.

We are not technically in a recession right now. However, the odds of entering one have increased. Every bank has now suggested that the longer this uncertainty is around, the more that will affect consumer confidence, the more it’ll affect business confidence, and the more we have a chance of slipping into a recession.

So, we’ve got a beautiful chart here, which shows 16 of the last 20% or greater market declines in the last hundred years. Do you want to spend a few moments and give us your observations on it? And I’ll share mine right after.

Marcelo: Biggest takeaway here, Keith, is about 70% of these bear markets have been solved within one year. So, it happens quick, and the recovery is quick. Now, there are some that are more extreme—I think people know which ones—but the vast majority are: you get one year, 365 days, you’re in and out. You saw the big drawdown, and you’re back to where you were.

So, people have to sometimes zoom out and say, “These things—they hurt. Yes, it’s not pleasant to go through them.” But they are resolved pretty quickly. Because markets do react quickly these days, because of technology and how information gets transmitted. But that’s the biggest thing for me.

Keith: I agree. I mean, it’s a slide that is produced by Dimensional, which helps give us some perspective. It’s intentional here to shed light in terms of how these corrections work.

Most of our clients—and most of our listeners in general—if you ask them about their time horizon, they would say, “I’m saving for the next 10 years, 20 years, 30 years, 40 years.” And so, when 70% of these major corrections are resolved—meaning that they went from the bottom of that period, wherever the correction is the worst, back to where it started—it took less than a year to recover.

A year, when you’re looking at a 20-year horizon, doesn’t seem as big. And of that remaining 30%, half of that 30% is resolvable within two years. And there are just a few occasions where you need to have the ability to withstand five years. And that’s really a minority. It can happen—I’m not suggesting that it can’t happen—but I think having perspective around this is so big.

Marcelo: Especially now.

Keith: Because, you know, we often hear individuals say, “Yeah, but if there’s a recession, the stock market will correct.” No ifs, ands, or buts. We don’t know if that’s 10%, 20%, 30% or 40%—it’s going to correct.

However, it’s going to come back faster than people think. And it’s going to come back quicker than people think. That, to me, is really important—an important message that we have to get out.

The next point we wanted to raise was, if we were to be in a recession—and again, you can usually only quantify this after the fact, like you go back in time and say, “Yes, the recession started 12 months ago.” But if we were to get in a recession, typically, how do stocks perform over a three-year period from that point on?

Marcelo: Mostly positive. I mean, from all the periods we’re looking at here, 80% of them are positive after three years.

Keith: Twenty percent of the time, three years after a recession starts, your investment returns are negative. The vast majority of times, if you can withstand two to three years, they’re significantly positive.

This has been a great discussion, Marcelo. We did it intentionally, and it’s kind of a special update for our listeners and for our clients on the recent volatility—how it came about, why it came about, our recommendations and perspective.

Let’s wrap up today’s episode with some summary themes of what we should do and what key messages we want to leave our listeners. So how do we get through volatility successfully?

Marcelo: Perspective. So, review the evidence on how markets work. Go back in history. Become a reader of history. Understand how drawdowns and recessions and bear markets work. We’ve just gone through some numbers now, but I think that helps to provide some perspective when we’re living through massive volatility.

Number two is review your long-term goals. Obviously, if you’re working with an advisor, your retirement money—and the money that’s supposed to get you through till age 95 or 100—should be adjusted for your goals. It doesn’t make sense to be living with massive volatility if you have a short-term horizon.

Now, if you have a shorter-term horizon for certain money, you shouldn’t be investing in the market. Yeah. So that’s very important.

Embrace an evidence-based investment philosophy. I think that’s going to steer you clear of a lot of trouble. And that’s not just for periods of volatility—I think that’s a recommendation we’ve had since the beginning.

Keith: So, what do you mean by evidence-based investment philosophy?

Marcelo: Believe in principles. Believe in the evidence. And when you have a philosophy, it’s like a North Star—we’ve talked about this, right? It’s a moral code that you have for your investment approach. And if you have something that’s solid and it’s based on evidence and you know that it works, that can get you through the bad times.

Keith: So, you’re speaking about don’t do market timing, don’t do tactical asset allocation, don’t do speculation. Make sure your portfolio’s diversified. Make sure your costs are lower—that type of thing.

Marcelo: And then embrace the power of advice. Whether you’re an 85-year-old client or 60 years old—if you’re working with an advisor, trust that advisor. That they have your best interests and that you’ve hired them for a reason. We’re here for clients, right?

But even in a DIY situation, I think people can rely on some advice too. And it’s a different conversation for another day. But I think that’s the one thing where a DIY person could fall a little bit in this type of situation—where they don’t have that person who can provide some calm and perspective and grab them by the hand and help them zoom out.

So those are the four things that I see here. But I think you pretty much agree with that.

Keith: Absolutely. I 100% agree with it. What I would leave—as recommendations for our listeners—is I’m going to respond with a Vanguard piece that I saw this week that I thought was beautiful.

They basically suggest a couple of things. First, they say stay clear of tactical asset allocation. I kind of chuckled, because it’s exactly what we’ve always said. They say it doesn’t work; it’s going to get you into trouble, and it’s going to create anxiety—and you can’t trade through these markets. So, stay clear, and focus on four key principles. And I thought their four key principles were really good.

First is make sure your goals are still appropriate. Reevaluate your goals and make sure they’re in line with your investment horizon and the way you’ve set up your portfolio.

Number two, make sure you diversify. We’ve spoken about this before, but diversify across asset classes, diversify across regions.

Marcelo: Which is part of the investment philosophy.

Keith: Absolutely. You know, the United States market isn’t doing all as well of a sudden as international and Canada. So, diversify. Diversify geographically. Diversify by industrial sector. Keep your costs low—keep your costs super low—and maintain that for as long as possible.

And then finally, maintain long-term discipline and maintain perspective, which we’ve talked about and we tried to bring in today’s episode. So those are the four pieces that Vanguard, which is one of the largest investment management, very pro friendly, very a great organization.

To me, those were four. Really main recommendations that I think are worth repeating. So Marcello, thank you so much. I know this was a session we put together quickly. We wanted to make sure we could get this important information out. Thank you so much. Any final comments?

Marcelo: Nope. I think it’s a great episode for our listeners. Feel free to share it with anyone who’s feeling anxiety about the markets. We’re not the oracles of reason here, but I think we’ve been around enough to know what works and what doesn’t. And it’s not like we’re predicting, but we know what a solid investment philosophy and a sensible approach can do for clients.

It’s funny—people ask me all the time when I tell them what I do for a living, “Oh, you must be busy. Like, you’re getting phone calls off the charts.” We’re actually not getting that many phone calls because we spend a lot of time with clients at the beginning—explaining to them how markets work, and that we are going to live through volatility.

Keith: Well, we do a lot of outreach—whether it’s podcasts, reaching out to clients. All of our advisors are working with all of our clients, trying to make sure that everything’s okay. But you’re right.

Marcelo: So, I think that’s worth some gold there.

Keith: On that note, Marcelo, thank you very much. And to our listeners, thank you for tuning in. Good luck. We’ll see you next time.

Marcelo: Thank you.

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect