I can’t count the number of times I have met serious and smart investors who have told me that.

To ensure a prosperous and financially secure future, we need to understand the potential roadblocks that can prevent us from succeeding. All too often, investors rush to implement a solution or buy an investment hoping that it will fill the gap created by previous portfolio hiccups, shortfalls, or downright mistakes. The desire to repair our immediate investment concerns may be quite valid; however, short-term adjustments usually do not result in any meaningful long-term impact.

For the winning strategies discussed in my book, The Empowered Investor, to pay off in the long run, before putting these strategies to work, investors must be aware of the pitfalls that await the unsuspecting. Knowing the rules of the playing field can save you a lot of headaches down the road — and dramatically improve your odds of future success.

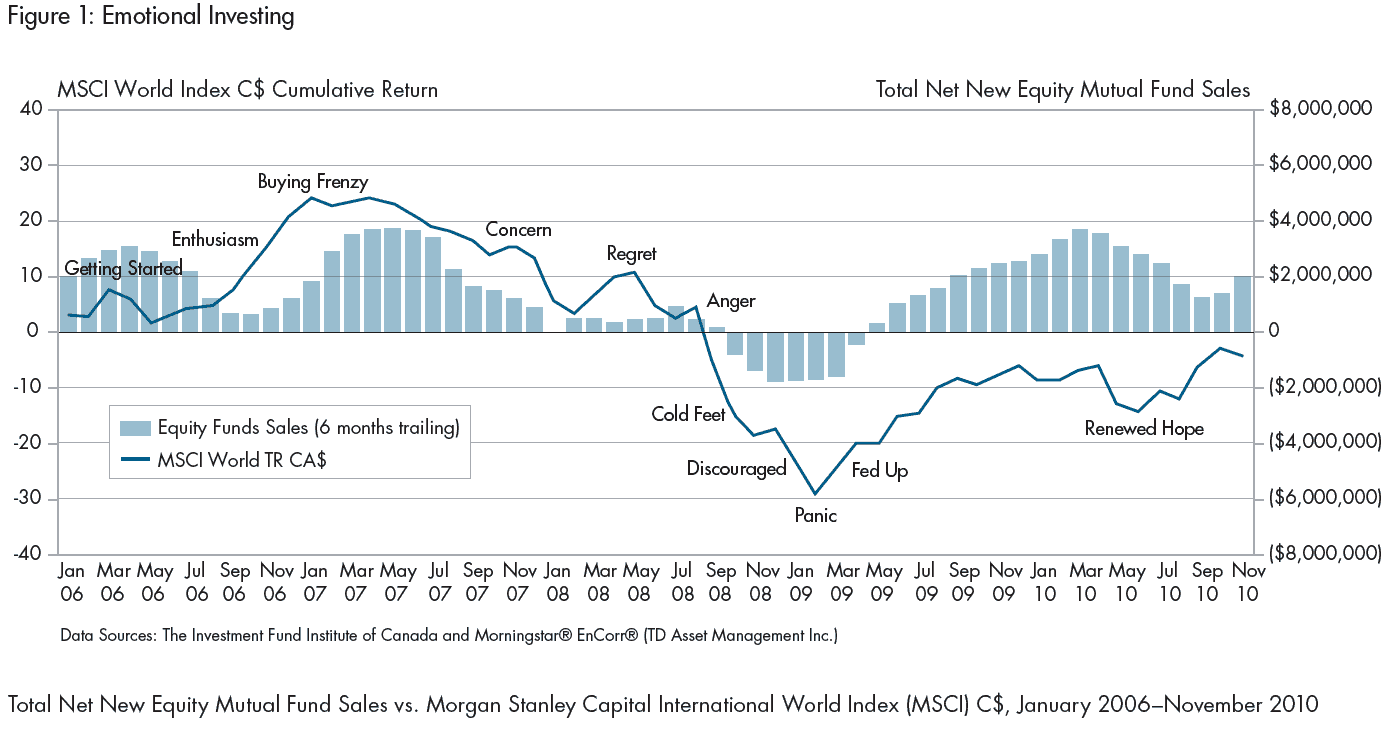

While the eight common investment pitfalls you will see in the coming articles are not new, they are more relevant now than ever. Investors are more likely to make knee-jerk decisions during volatile periods. Unfortunately, the data on investor response are not encouraging.

Our emotional attachment to money, family finances, and investing stir up our most primal feelings of security and our desire to “make it” in life. Wrestling with these feelings while riding the roller coaster of stock and bond returns may lead us to make portfolio decisions that we later regret.

Thanks to the new field of behavioural finance, we now know that humans have biases and filters that cloud our financial judgment and ultimately lead to poor decisions about when to buy or sell assets. While some of these biases are positive attributes in other areas of life, they can be disastrous in investing. For example, high levels of confidence may help you in a job interview, but bravado as an investor can lead to self-destructive behaviour.

Over the next several articles, I will outline the most common pitfalls for investors. If you’re ready to read about them now, you can download a free copy of my entire book, The Empowered Investor.