There are 9 critical factors you must consider when thinking about your long-term investments. Ignoring them can lead to costly

We pay close attention to each and every aspect detailed in these concepts. Careful diligence is part of who we are and how we work with our clients. We embrace these core components and implement them in our investment and client service philosophy.

These 9 critical factors are relevant in all market cycles – good or bad.

1. Planning is critical to building a sustainable lifestyle

Figure 1: Set Planning Targets

Are you on track to financial independence? Knowing what is required to reach your goals is only half the battle; implementing your action plan completes the planning process. To discover and learn more about the planning process, see the Creating

Seeking advice

2. Achieve long-term success with asset allocation

Asset class investing is the most prudent and successful long-term investment management strategy available to Canadian investors. More so than any other deciding factors (such as market predictions, investment TV shows,

Figure 2: Portfolio Structure and Asset Allocation Determine Performance

This leaves only 4% of the variation to explain.

Asset allocation is one of the most important decisions investors and advisors must make, and that is why it is a cornerstone of our investment philosophy.

3. Practice good diversification

Most investors know that it is prudent to diversify, but do they truly practice diversification in their portfolios? Many people who believe they are well diversified actually have highly concentrated and risky portfolios. Investors often discover that their portfolios are filled with overlapping strategies resulting in poor asset class diversification. Good asset class diversification occurs when many distinct and productive asset classes are added together to build an effective long-term portfolio strategy.

Figure 3: Poor Asset Class Diversification vs. Good Asset Class Diversification

As Figure 3 aims to show, good diversification is achieved by holding positions across a wide variety of asset classes.

A client’s personal objectives, life stage, cash flow needs, and tolerance to risk or uncertainty all vary and will impact the percentages of asset classes used in their portfolios.

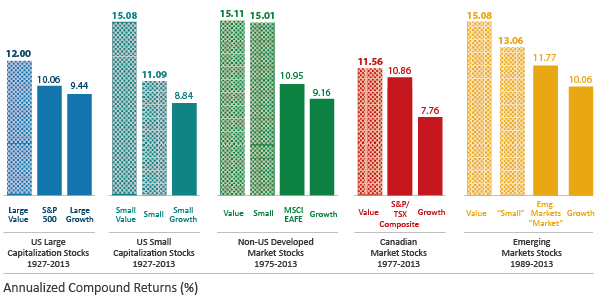

4. Include value & small cap stocks

While many investors believe the best way to grow their investments over time is to invest in “growth companies”, results in virtually every geographic region around the world show that investments in value companies (low market price-to-book ratio, out of favor, neglected companies) have actually produced higher returns. Small companies have also produced higher returns than their larger,

Figure 4 highlights the additional returns derived from investments in value and small company exposures in various global markets.

Figure 4: Value and Small Cap Stocks Outperform Growth Stocks

While there are many possible explanations for these return outcomes, we subscribe to the research of Eugene Fama and Ken French (both highly regarded financial market economists who are actively involved with Dimensional Fund Advisors, and the former a Nobel Prize recipient in 2013); who concluded that risk and return are related. Value and small companies are perceived as riskier investments and

So how do we implement this concept in your portfolio? Highly diversified investment funds managed by Dimensional Fund Advisors are used to include value and small companies in your portfolio. We “tilt” the portfolio to these asset classes and include others such as general market exposure (which will include large growth companies). Diversification within each asset class as well as across multiple asset classes is always a key component in each and every client portfolio.

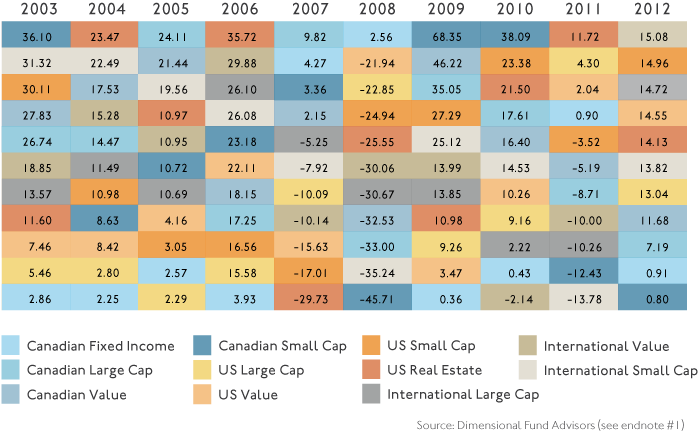

5. Avoid market timing and switching between asset classes

The truth of the matter is that no one can consistently predict future asset prices. As seen in Figure 5, markets and asset classes often move in random and unpredictable fashion. Each

Figure 5: Don’t Try to Predict the Unpredictable – Annual Asset Class Ranking:

We do not attempt to switch back and forth between various asset classes as research shows that it is unproductive. Market timing and tactical asset allocation

6. Discover index or passively managed asset class investing

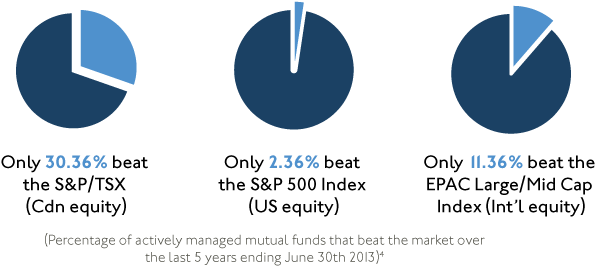

Over the long-term, few actively managed strategies have been able to match index or asset class returns. Figure 6 shows the percentage of actively managed strategies that have outperformed relevant benchmarks in the last five years ending June 30th, 2013.

Figure 6: Most Actively Managed Strategies do not Outperform Relative Benchmarks

The good news is that Asset Class Strategies that track asset classes and indices are available to private client investors around the world.

There are many reasons why we prefer to use index (in the form of Exchange Traded Funds) or passively managed asset class investments (in the form of Dimensional Fund Advisor funds) when building and managing your long-term diversified portfolios. Long-term performance is one of them. Other benefits to your portfolio

7. Discover index or passively managed asset class investing

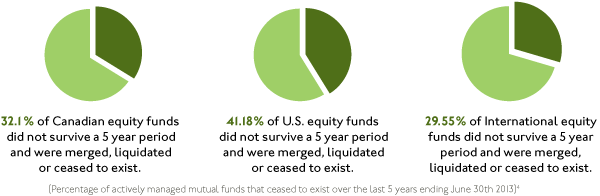

Major asset classes will always survive. Investment management offerings, however, may not. One in three actively managed investment strategies do not “survive” as shown in Figure 7:

Figure 7: Many Actively Managed Funds do not Survive

Investing in passively managed asset class strategies or ETFs that track indices can significantly reduce “survivorship” risks in your portfolio and can produce a more consistent long-term investment experience.

8. Protect yourself against investment obstacles & pitfalls

We manage your assets on a discretionary basis to reflect the goals agreed upon in your Investment Policy Statement. This protects you from many of the common pitfalls facing investors. The structured portfolio approach is also another layer of protection against these pitfalls. Our fiduciary responsibility and our means of compensation are your greatest protection from the conflicts of interest found within the “sales & commission” culture of the financial services industry.

9. Controlling emotions

Humans are not “hardwired” to be good at investing. Emotions and cognitive biases often get in the way. Fear, greed, hindsight

Understanding how we think about our money, our security, and our wealth can be a very complex undertaking. Being aware of how the mind can play “tricks” or how we can possibly have “hang-ups” or “mental obstacles” when we think of wealth & portfolios is very important if you wish to become a successful long-term investor.